Question

Nucor is the largest steel producer in the United States. Please consider the excerpts from Nucors annual report for fiscal year 2014 presented in the

Nucor is the largest steel producer in the United States. Please consider the excerpts from Nucor’s annual report for fiscal year 2014 presented in the next page and answer the following questions.

a. What inventory cost flow assumption(s) does Nucor use to determine the cost of inventories?

b. Suppose Nucor had used FIFO as a cost flow assumption for all its inventories. Assume a tax rate of 35%. Would net income for December 31st, 2014 be higher, lower or the same as currently reported? If you answer higher or lower, please indicate by how much.

c. Did Nucor save taxes cumulatively over the years since inception (up to December 31st, 2014) by using LIFO instead of FIFO as a cost flow assumption? If so, by how much? If not, why?

d. What is Nucor’s gross profit margin (=(sales-cost of sales)/sales) as reported? What would Nucor gross-profit margin be if the company had used FIFO as a cost flow assumption for all its inventories? Which of the two numbers you calculated is more informative?

e. Note 6 states that “Use of lower of cost or market reduced inventories by $2.7 million at December 31, 2014.” What does this mean? What are the financial statement implications of this event?

Excerpts from Nucor’s Financial Statement (Contd.)

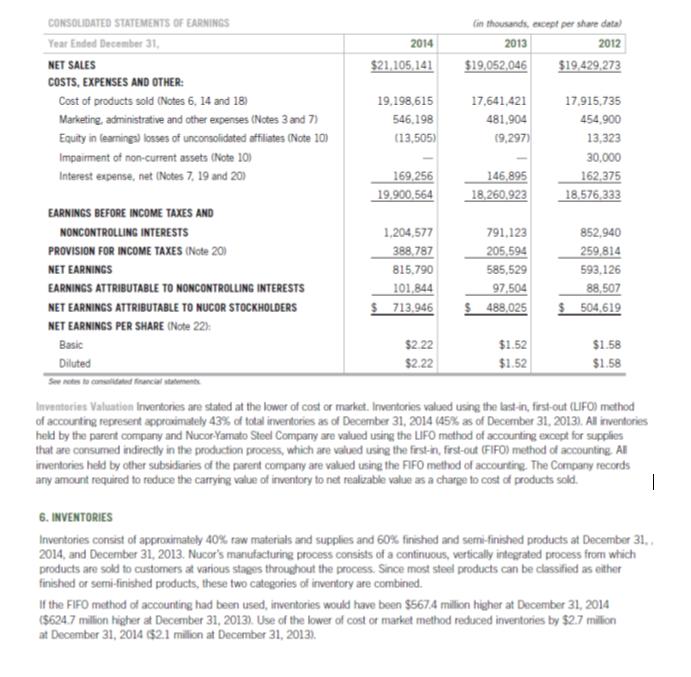

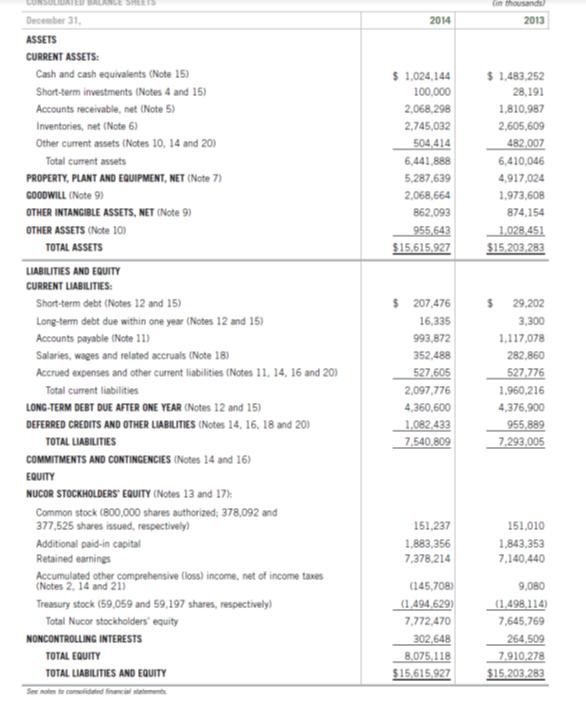

CONSOLIDATED STATEMENTS OF EARNINGS Year Ended December 31, NET SALES COSTS, EXPENSES AND OTHER: Cost of products sold (Notes 6, 14 and 18) Marketing, administrative and other expenses (Notes 3 and 7) Equity in learnings) losses of unconsolidated affiliates (Note 10) Impairment of non-current assets (Note 10) Interest expense, net (Notes 7, 19 and 20) EARNINGS BEFORE INCOME TAXES AND NONCONTROLLING INTERESTS PROVISION FOR INCOME TAXES (Note 20) NET EARNINGS EARNINGS ATTRIBUTABLE TO NONCONTROLLING INTERESTS NET EARNINGS ATTRIBUTABLE TO NUCOR STOCKHOLDERS NET EARNINGS PER SHARE (Note 22): Basic Diluted See notes to consolidated financial statements 2014 $21,105,141 19,198,615 546,198 (13,505) 169,256 19,900,564 1,204,577 388,787 815,790 101,844 $713,946 $2.22 $2.22 (in thousands, except per share data) 2013 2012 $19,429,273 $19,052,046 17,641,421 481,904 (9,297) 146,895 18,260,923 791,123 205,594 585,529 97,504 $ 488,025 $1.52 $1.52 17,915,735 454,900 13,323 30,000 162,375 18,576,333 852,940 259,814 593,126 88,507 $504,619 $1.58 $1.58 Inventories Valuation Inventories are stated at the lower of cost or market. Inventories valued using the last-in, first-out (LIFO) method of accounting represent approximately 43% of total inventories as of December 31, 2014 (45% as of December 31, 2013). All inventories held by the parent company and Nucor-Yamato Steel Company are valued using the LIFO method of accounting except for supplies that are consumed indirectly in the production process, which are valued using the first-in, first-out (FIFO) method of accounting. All inventories held by other subsidiaries of the parent company are valued using the FIFO method of accounting. The Company records any amount required to reduce the carrying value of inventory to net realizable value as a charge to cost of products sold. I 6. INVENTORIES Inventories consist of approximately 40% raw materials and supplies and 60% finished and semi-finished products at December 31, 2014, and December 31, 2013. Nucor's manufacturing process consists of a continuous, vertically integrated process from which products are sold to customers at various stages throughout the process. Since most steel products can be classified as either finished or semi-finished products, these two categories of inventory are combined. If the FIFO method of accounting had been used, inventories would have been $567.4 million higher at December 31, 2014 ($624.7 million higher at December 31, 2013). Use of the lower of cost or market method reduced inventories by $2.7 million at December 31, 2014 ($2.1 million at December 31, 2013).

Step by Step Solution

3.52 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

a Inventory Cost flow assumptions Nucor being parent company has used LIFO method of accounting for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started