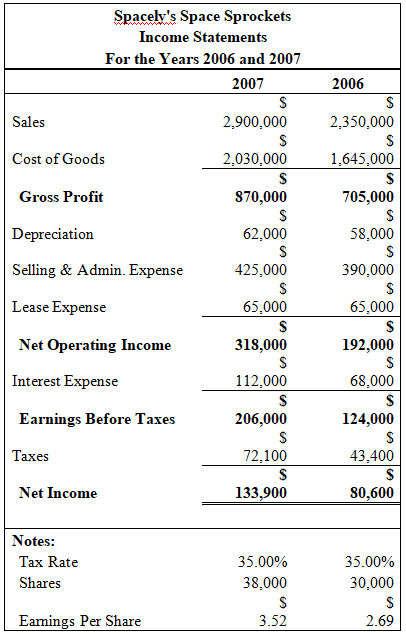

1. If sales were $3,200,000 in 2007 rather than $2,900,000. The 2007 net income would be $433,900...

Question:

1. If sales were $3,200,000 in 2007 rather than $2,900,000. The 2007 net income would be $433,900 and the retained earnings would be $969,000 Changing the tax rate to 40%, would cause the 2007 net income to be $123,600 and the retained earnings would be $659,600.

2. Create a common-size income statement for 2006 and 2007. This statement should be created on a separate worksheet with all formulas linked directly to the income statement.

| Spacely's Space Sprockets | ||

| Balance Sheet | ||

| For the Year Ended December 31, 2007 | ||

| 2007 | 2006 | |

| Assets | ||

| Cash | $ 52,000 | $ 41,000 |

| Marketable Securities | $ 25,000 | $ 21,000 |

| Accounts Receivable | $ 420,000 | $ 372,000 |

| Inventory | $ 515,000 | $ 420,000 |

| Total Current Assets | $ 1,012,000 | $ 854,000 |

| Gross Fixed Assets | $ 2,680,000 | $ 2,170,000 |

| Accumulated Depreciation | $ 547,000 | $ 485,000 |

| Net Plant & Equipment | $ 2,133,000 | $ 1,685,000 |

| Total Assets | $ 3,145,000 | $ 2,539,000 |

| Liabilities & Owner's Equity | ||

| Accounts Payable | $ 505,000 | $ 310,000 |

| Accrued Expenses | $ 35,000 | $ 30,000 |

| Total Current Liabilities | $ 540,000 | $ 340,000 |

| Long-term Debt | $ 1,168,100 | $ 1,061,000 |

| Total Liabilities | $ 1,708,100 | $ 1,401,000 |

| Common Stock | $ 76,000 | $ 60,000 |

| Additional Pain-in-Capital | $ 691,000 | $ 542,000 |

| Retained Earnings | $ 669,900 | $ 536,000 |

| Total Owner's Equity | $ 1,436,900 | $ 1,138,000 |

| Total Liab. & Owner's Equity | $ 3,145,000 | $ 2,539,000 |

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted: