A brokerage firm has been tasked with investing $500,000 for a new client. The client has asked

Question:

• At least 20% in municipal bonds

• At least 10% each in real estate stock and pharmaceutical stock

• At least 40% in a combination of energy and domestic automobile stocks, with each accounting for at least 15%

• No more than 50% of the total amount invested in energy and automobile stocks in a combination of real estate and pharmaceutical company stock

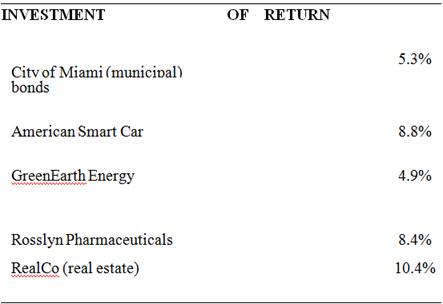

Subject to these constraints, the client’s goal is to maximize projected return on investments. The broker has prepared a list of high-quality stocks and bonds and their corresponding rates of return, as shown in the following table.

Formulate this portfolio selection problem by using LP and solve it by using Excel.

Stocks

Formulate this portfolio selection problem by using LP and solve it by using Excel.

Stocks

Stocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Broker

A broker is someone or something that acts as an intermediary third party, managing transactions between two other entities. A broker is a person or company authorized to buy and sell stocks or other investments. They are the ones responsible for... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Decision Modeling With Spreadsheets

ISBN: 718

3rd Edition

Authors: Nagraj Balakrishnan, Barry Render, Jr. Ralph M. Stair

Question Posted: