A first year co-op student working for Solutions.com recorded the transactions for the month. He wasn't exactly

Question:

A first year co-op student working for Solutions.com recorded the transactions for the month. He wasn't exactly sure how to journalize and post, but he did the best he could. He had a few questions, however, about the following transactions.

1. Cash received from a customer on account was recorded as a debit to Cash of $360 and a credit to Accounts Receivable of $630, instead of $360.

2. A service provided for cash was posted as a debit to Cash of $2,000 and a credit to Service Revenue of $2,000.

3. A debit of $880 for services provided on account was neither recorded nor posted. The credit was recorded correctly.

4. The debit to record $1,000 of cash dividends was posted to the Salaries and Wages Expense account.

5. The purchase, on account, of a computer that cost $2,500 was recorded as a debit to Supplies and a credit to Accounts Payable.

6. A cash payment of $495 for salaries was recorded as a debit to Dividends and a credit to Cash.

7. Payment of month's rent was debited to Rent Expense and credited to Cash, $850.

8. Issue of $5,000 of common shares was credited to the Common Stock account, but no debit was recorded.

Instructions

(a) Indicate which of the above transactions are correct, and which are incorrect.

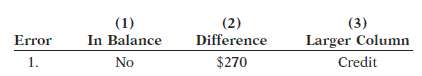

(b) For each error identified in (a), indicate (1) whether the trial balance will balance;

(2) The amount of the difference if the trial balance will not balance; and

(3) The trial balance column that will have the larger total. Consider each error separately. Use the following form, in which transaction 1 is given as anexample.

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Financial Accounting Tools for business decision making

ISBN: 978-0470534779

6th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso