Question: a. Given the following information, calculate the expected value for Firm Cs EPS. E(EPS A ) = $5.10 and A = $3.61; E(EPS B

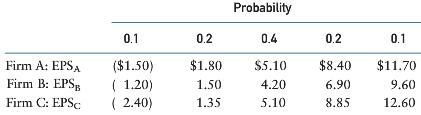

a. Given the following information, calculate the expected value for Firm C’s EPS. E(EPSA) = $5.10 and σA = $3.61; E(EPSB) = $4.20 and σB = $2.96; and σC = $4.11.

b. Discuss the relative riskiness of the three firms’ (A, B, and C) earnings.

Probability 0.1 0.2 0.4 0.2 0.1 Firm A: EPSA ($1.50) 1.80 S5.10 $8.40 $1.70 Firm B: EPS 1.20) 15 4.206.909.60 Firm C: EPSc 2.40) 1.35 5.10 8.85 12.60

Step by Step Solution

3.45 Rating (177 Votes )

There are 3 Steps involved in it

a Expected EPS for Firm C EEPSC 01240 02135 04510 02885 011260 02... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

352-B-C-F-C-V (541).docx

120 KBs Word File