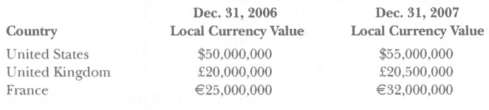

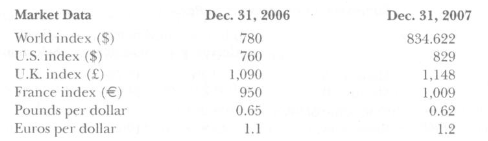

A U.S. portfolio manager has a global equity portfolio with investments in the United States, United Kingdom,

Question:

a. Calculate the local currency return and dollar return on the portfolio for the period December 31, 2006, to December 31, 2007.

b. Decompose the total return on the portfolio into the following components:

– Capital gains in local currency

– Currency contribution

c. Decompose the total return on the portfolio into the following components:

– Market component

– Security selection contribution

– Currency component

d. Carry out a global performance evaluation for the portfolio relative to the World index. Make sure the global performance attribution identifies the following components:

– Benchmark return

– Market allocation

– Currency allocation

– Security selection

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: