Allocation of common costs. Sunny Dunn, a self-employed consultant near Sacramento, received an invitation to visit a

Question:

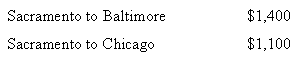

Allocation of common costs. Sunny Dunn, a self-employed consultant near Sacramento, received an invitation to visit a prospective client in Baltimore. A few days later, she received an invitation to make a presentation to a prospective client in Chicago. She decided to combine her visits, traveling from Sacramento to Baltimore, Baltimore to Chicago, and Chicago to Sacramento. Dunn received offers for her consulting services from both companies. Upon her return, she decided to accept the engagement in Chicago. She is puzzled over how to allocate her travel costs between the two clients. She has collected the following data for regular round-trip fares with no stopovers:

Dunn paid $1,800 for her three-leg flight (Sacramento—Baltimore, Baltimore—Chicago, Chicago—Sacramento). In addition, she paid $30 each way for limousines from her home to Sacramento Airport and back when she returned.

1. How should Dunn allocate the $1,800 airfare between the clients in Baltimore and Chicago using (a) the stand-alone cost-allocation method, (b( the incremental cost-allocation method, and (c) the Shapley value method?

2. Which method would you recommend Dunn use and why?

3. How should Dunn allocate the $60 limousine charges between the clients in Baltimore and Chicago?

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav