Alvamar Company has the following data for the weekly payroll ending January 31 Employees are paid 112

Question:

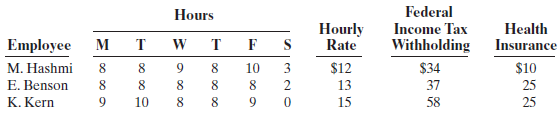

Alvamar Company has the following data for the weekly payroll ending January 31

Employees are paid 11⁄2 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 8% on the first $100,000 of gross earnings. Alvamar Company is subject to 5.4% state unemployment taxes and 0.8% federal unemployment taxes on the first $7,000 of gross earnings.

Instructions

(a) Prepare the payroll register for the weekly payroll.

(b) Prepare the journal entries to record the payroll and Alvamar’s payroll tax expense.

Federal Income Tax Withholding Hours Health Insurance Hourly Rate Employee M. Hashmi E. Benson K. Kern M т т 3 8. 10 2 $34 37 $12 13 $10 25 8. 8. 8. 8. 15 9. 10 8. 9. 58 25 en 2 O

Step by Step Answer:

a ALVAMAR COMPANY Payroll Register For the Week Ending January 31 Earnings Deductions Employee Total ...View the full answer

Accounting Principles

ISBN: 9780471980193

8th Edition

Authors: Jerry J Weygandt, Donald E Kieso, Paul D Kimmel

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Accounting questions

-

Alvarez Company has the following data for the weekly payroll ending January 31. Employees are paid 1 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are...

-

Piniella Company has the following data for the weekly payroll ending January 31. Employees are paid 112 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes...

-

Welstead Company has the following data for the weekly payroll ending January 31. Employees are paid 112 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes...

-

A solid homogeneous disk 900 mm in diameter with a mass of 140 kg is rolled up 20 incline by a force of 1000 N, applied parallel to the plane. Assuming no slipping. determine the speed of the disk...

-

In the special report, "Bitter Pill: Why Medical Bills Are Killing Us" (TIME, Vol. 181, No. 8, 2013), S. Brill presented an in-depth investigation of hospital billing practices that reveals why U.S....

-

The mechanism used in Figure 13.13 to make scheduler code reentrant employs a single OS-provided lock for all the scheduling data structures of the application. Among other things, this mechanism...

-

Establish the properties claimed for the risk-free return proxies: (a) Show that var(R) var(R p + bmep)for every return R. (b) Show that cov(R p,R p +bzep) = 0. (c) Prove (5.23), showing that R p...

-

1. How does Ready-Made communicate the demographics of its reader base to advertisers who want to see specific statistics about Ready-Mades target market? 2. What sort of segmentation does Ready-Made...

-

Walton, Inc. estimates manufacturing overhead costs for the Year 3 accounting period as follows. Equipment depreciation Supplies Materials handling Property taxes Production setup Rent Maintenance...

-

1. Calculate the internal growth rate and sustainable growth rate for S&S Air. What do these numbers mean? 2. S&S Air is planning for a growth rate of 12 percent next year. Calculate the EFN for the...

-

Employee earnings records for Medenciy Company reveal the following gross earnings for four employees through the pay period of December 15. C. Ogle .... $93,500 D. Delgado . $96,100 L. Jeter .......

-

Selected data from a February payroll register for Gerfield Company are presented below. Some amounts are intentionally omitted FICA taxes are 8%. State income taxes are 3% of gross...

-

Consider a Michelson interferometer that uses a sodium lamp as its source. A sodium lamp gives a large intensity at two wavelengths, 589.00 nm and 589.59 nm, in the yellow range of the visible...

-

Problem 2-26 (Static) Complete the balance sheet using cash flow data LO 2-2, 2-3, 2-5, 2-6 Following is a partially completed balance sheet for Epsico Incorporated at December 31, 2022, together...

-

Consider the following potential events that might have occurred to Global Conglomerate on December30, 2018. For eachone, indicate which line items inGlobal's balance sheet would be affected and by...

-

An epidemiologist plans to conduct a survey to estimate the percentage of women who give birth. How many women must be surveyed in order to be 95% confident that the estimated percentage is in error...

-

Jamonit Ltd is a non-group employer which paid wages of $136,000 in the Northern Territory during March 2021. The company does not pay wages in any other state. Calculate the payroll tax payable in...

-

Following is a partially completed balance sheet for Epsico Inc. at December 31, 2019, together with comparative data for the year ended December 31, 2018. From the statement of cash flows for the...

-

Why would measures of employees attitudes about a training program and measures of actual learning be different?

-

As water moves through the hydrologic cycle, water quality changes are common because of natural phenomena or anthropogenic pollution. Using Figure 11.1, describe how water-quality changes occur...

-

Determine whether or not the region bounded by the curves is vertically simple and/or horizontally simple. y = x 2 , x = y 2

-

Why may a trial balance not contain up-to-date and complete financial information?

-

Depreciation is a valuation process that results in the reporting of the fair market value of the asset. Do you agree? Explain.

-

Explain the differences between depreciation expense and accumulated depreciation.

-

Jeannie is an adjunct faculty at a local college, where she earned $680.00 during the most recent semimonthly pay period. Her prior year-to-date pay is $18,540. She is single and has one withholding...

-

The company sold merchandise to a customer on March 31, 2020, for $100,000. The customer paid with a promissory note that has a term of 18 months and an annual interest rate of 9%. The companys...

-

imer 2 0 2 4 Question 8 , PF 8 - 3 5 A ( similar to ) HW Score: 0 % , 0 of 1 0 0 points lework CH 8 Part 1 of 6 Points: 0 of 1 5 Save The comparative financial statements of Highland Cosmetic Supply...

Study smarter with the SolutionInn App