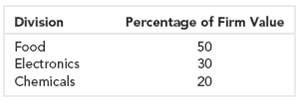

Amalgamated Products has three operating divisions: To estimate the cost of capital for each division, Amalgamated has

Question:

Amalgamated Products has three operating divisions:

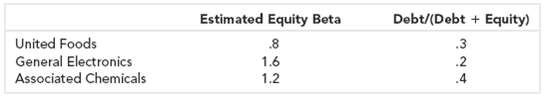

To estimate the cost of capital for each division, Amalgamated has identified the following three principal competitors:

Assume these betas are accurate estimates and that the CAPM is correct.

a. Assuming that the debt of these firms is risk-free, estimate the asset beta for each of Amalgamated's divisions.

b. Amalgamated's ratio of debt to debt plus equity is .4. If your estimates of divisional betas are right, what is Amalgamated's equity beta?

c. Assume that the risk-free interest rate is 7 percent and that the expected return on the market index is 15 percent. Estimate the cost of capital for each of Amalgamated?s divisions.

d. How much would your estimates of each division's cost of capital change if you assumed that debt has a beta of .2?

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Expected Return

The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these...

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers