The questions in this problem are based on Blue Nile, Inc. To answer the questions, you will

Question:

The questions in this problem are based on Blue Nile, Inc. To answer the questions, you will need to download Blue Nile’s 2004 Form 10-K at www.sec.gov/edgar/searchedgar/company search.html. Once at this website, input 01K code 1091171 and hit enter. In the gray box on the right-hand side of your computer screen define the scope of your search by inputting 10-K and then pressing enter. Select the 10-K/A with a filing date of March 25, 2005. You do not need to print this document to answer the questions. You will need the information below to answer the questions.

Required:

1. What is Blue Nile’s strategy for success in the marketplace? Does the company rely primarily on a customer intimacy, operational excellence, or product leadership customer value proposition? What evidence from the 10-K supports your conclusion?

2. What business risks does Blue Nile face that may threaten its ability to satisfy stockholder expectations? What are some examples of control activities that the company could use to reduce these risks? Are some of the risks faced by Blue Nile difficult to reduce through control activities? Explain.

3. Is Blue Nile a merchandiser or a manufacturer? What information contained in the 10-K supports your answer?

4. Using account analysis, would you label cost of sales and selling, general, and administrative expense as variable, fixed, or mixed costs? Why? Cite one example of a variable cost, step-variable cost, discretionary fixed cost, and committed fixed cost for Blue Nile.

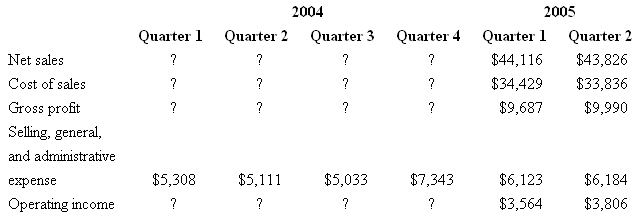

5. Fill in the blanks in the table above based on information contained in the 10-K. Using the high-low method, estimate the variable and fixed cost elements of the quarterly selling, general, and administrative expense. Express Blue Nile’s variable and fixed selling, general, and administrative expenses in the form Y = a + bX, where X is net sales.

6. Prepare a contribution format income statement for the third quarter of 2005 assuming that Blue Nile’s net sales were $45,500 and its cost of sales as a percentage of net sales remained unchanged from the prior quarter.

7. How would you describe Blue Nile’s cost structure? Is Blue Nile’s cost of sales as a percentage of sales higher or lower than competitors with bricks and mortar jewelry stores?

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer