As kill Corporation (As kill), a public corporation, has concluded negotiations with Basket Corporation (Basket) for the

Question:

As kill Corporation (As kill), a public corporation, has concluded negotiations with Basket Corporation (Basket) for the purchase of all of Basket’s net assets at fair value, effective January 1, 20X7. An examination at that date by independent experts disclosed that the fair value of Basket’s inventories was $ 300,000; the fair value of its machinery and equipment was $ 320,000.

Additional Information:

• The fair value of the patent was $ 62,000. The values of the accounts receivable and of the current and long- term liabilities were equal to their carrying value.

• The purchase agreement stated that the purchase price of all the net assets will be $ 540,000 payable in cash.

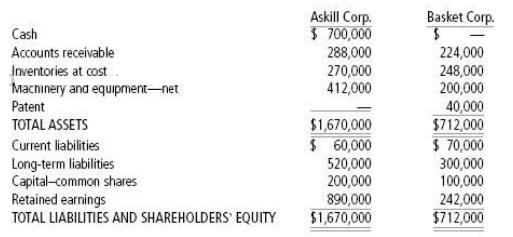

• Both corporations have December 31 year- ends. The statements of financial position of both corporations, as at the date of the implementation of the purchase agreement (January 1, 20X7), are as follows:

Required

1. What is the amount of goodwill that would be recorded for the business combination?

2. Prepare As kill’s SFP at January 1, 20X7.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0137030385

6th edition

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay