Assume that you are nearing graduation and that you have applied for a job with a local

Question:

Assume that you are nearing graduation and that you have applied for a job with a local bank. As part of the bank’s evaluation (interview) process, you have been asked to take an exam that covers several financial analysis techniques. The first section of the test addresses time value of money analysis. See how you would do by answering the following questions:

a. Draw cash flow time lines for (1) a $100 lump-sum cash flow at the end of Year 3, (2) an ordinary annuity of $100 per year for three years, and (3) an uneven cash flow stream of $50, $100, $75, and $50 at the end of Years 0 through 3.

b. (1) What is the future value of an initial $100 after three years if it is invested in an account paying 10 percent annual interest?

(2) What is the present value of $100 to be received in three years if the appropriate interest rate is 10 percent?

c. We sometimes need to find how long it will take a sum of money (or any- thing else) to grow to some specified amount. For example, if a company’s sales are growing at a rate of 20 percent per year, approximately how long will it take sales to triple?

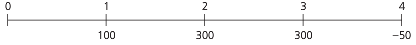

d. What is the difference between an ordinary annuity and an annuity due? What type of annuity is shown in the following cash flow timeline? How would you change it to the other type of annuity?

e. (1) What is the future value of a three-year ordinary annuity of $100 if the appropriate interest rate is 10 percent?

(2) What is the present value of the annuity?

(3) What would the future and present values be if the annuity were an annuity due?

f. What is the present value of the following uneven cash flow stream? The appropriate interest rate is 10 percent, compounded annually.

g. What annual interest rate will cause $100 to grow to $125.97 in three years?

h. (1) Will the future value be larger or smaller if we compound an initial amount more often than annually—for example, every six months, or semiannually—holding the stated interest rate constant? Why?

(2) Define the stated, or simple (quoted), rate (rSIMPLE), annual percentage rate (APR), the periodic rate (rPER), and the effective annual rate (rEAR).

(3) What is the effective annual rate for a simple rate of 10 percent, com- pounded semiannually? Compounded quarterly? Compounded daily?

(4) What is the future value of $100 after three years under 10 percent semiannual compounding? Quarterly compounding?

i. Will the effective annual rate ever be equal to the simple (quoted) rate? Explain.

j. (1) What is the value at the end of Year 3 of the following cash flow stream if the quoted interest rate is 10 percent, compounded semiannually?

(2) What is the PV of the same stream?

(3) Is the stream an annuity?

(4) An important rule is that you should never show a simple rate on a time-line or use it in calculations unless what condition holds? What would be wrong with your answer to parts (1) and (2) if you used the simple rate of 10 percent rather than the periodic rate of rSIMPLE/2 = 10%/2 = 5%?

k. (1) Construct an amortization schedule for a $1,000 loan that has a 10 percent annual interest rate that is repaid in three equal installments.

(2) What is the annual interest expense for the borrower and the annual interest income for the lender during Year 2?

l. Suppose on January 1 you deposit $100 in an account that pays a simple, or quoted, interest rate of 11.33463 percent, with interest added (compounded) daily. How much will you have in your account on October 1, or after nine months?

m. Now suppose you leave your money in the bank for 21 months. Thus, on January 1 you deposit $100 in an account that pays 11.33463 percent compounded daily. How much will be in your account on October 1 of the following year?

n. Suppose someone offered to sell you a note that calls for a $1,000 payment 15 months from today. The person offers to sell the note for $850. You have $850 in a bank time deposit (savings instrument) that pays a 6.76649 percent simple rate with daily compounding, which is a 7 percent effective annual interest rate; and you plan to leave this money in the bank unless you buy the note. The note is not risky—that is, you are sure it will be paid on schedule. Should you buy the note? Check the decision in three ways: (1) by comparing your future value if you buy the note versus leaving your money in the bank, (2) by comparing the PV of the note with your current bank investment, and (3) by comparing the rEAR on the note with that of the bank investment.

o. Suppose the note discussed in part (n) costs $850 but calls for five quarterly payments of $190 each, with the first payment due in three months rather than $1,000 at the end of 15 months. Would it be a good investment?

AnnuityAn annuity is a series of equal payment made at equal intervals during a period of time. In other words annuity is a contract between insurer and insurance company in which insurer make a lump-sum payment or a series of payment and, in return,... Future Value

Future value (FV) is the value of a current asset at a future date based on an assumed rate of growth. The future value (FV) is important to investors and financial planners as they use it to estimate how much an investment made today will be worth...

Step by Step Answer: