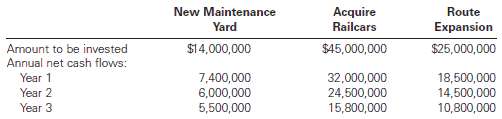

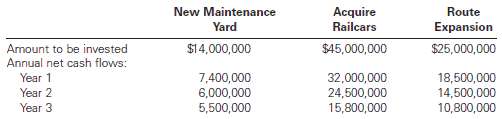

Atlantic Coast Railroad Company wishes to evaluate three capital investment proposals by using the net present value method. Relevant data related to the proposals are

Atlantic Coast Railroad Company wishes to evaluate three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows:

Instructions1. Assuming that the desired rate of return is 20%, prepare a net present value analysis for each proposal. Use the present value of $1 table appearing in this chapter.2. Determine a present value index for each proposal. Round to two decimal places. 3. Which proposal offers the largest amount of present value per dollar of investment?Explain.

New Maintenance Yard Acquire Railcars Route Expansion Amount to be invested Annual net cash flows: Year 1 Year 2 Year 3 $45,000,000 $14,000,000 $25,000,000 18,500,000 14,500,000 10,800,000 7,400,000 6,000,000 5,500,000 32,000,000 24,500,000 15,800,000

Step by Step Solution

3.31 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

1 Net Present Value ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

Document Format ( 1 attachment)

46-B-C-A-C-P-A (333).docx

120 KBs Word File

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards