Aurora Medical Center (AMC), located outside Phoenix, has an inpatient hospital and outpatient clinic. Because it is

Question:

Aurora Medical Center (AMC), located outside Phoenix, has an inpatient hospital and outpatient clinic. Because it is located in a retirement area, a substantial fraction of its patients are elderly, and hence their medical insurance is provided through the Medicare program of the federal government. Medicare outpatient clinic care is reimbursed by the federal government at cost. Each clinic with Medicare outpatients submits a reimbursement form to Medicare reporting the costs of treating these patients. Medicare inpatient reimbursement is based on predetermined rates depending on the diag-nosis. For example, all Medicare- paid hip replacements in Phoenix are reimbursed at $ 14,800 per patient, regardless of the hospital’s cost.

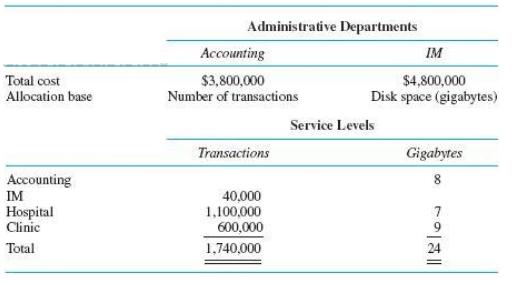

AMC has two administrative departments that provide services to both the hospital and the clinic: accounting and information management (IM). The accompanying tables summarize the ser-vice levels provided by these two departments:

Accounting department costs are distributed to users based on the number of transactions posted to the general ledger generated by that user. IM costs are distributed to users based on the gigabytes of storage dedicated to the user. Medicare guidelines allow these allocation bases to be used. Medicare also provides some discretion to hospitals in the methods used to allocate costs, as long as they are reasonable and generally accepted.

Required:

a. Design a report for assigning the accounting and IM costs to the hospital and clinic. How much of the costs of accounting and IM should be allocated to inpatients and outpatients?

b. Justify your design in (a). Explain why AMC should follow your suggestions.

Step by Step Answer:

Accounting for Decision Making and Control

ISBN: 978-0078025747

8th edition

Authors: Jerold Zimmerman