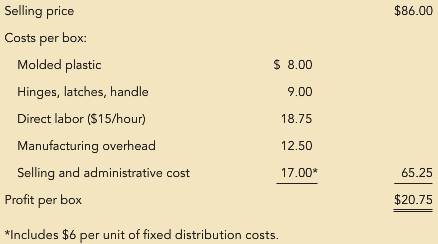

Avery, Inc., is a wholesale distributor supplying a wide range of moderately priced sporting equipment to large

Question:

Because Avery believes that it could sell 12,000 tackle boxes, the company has looked into the possibility of purchasing the tackle boxes from another manufacturer. Craig Products, a supplier of quality products, could provide up to 9,000 tackle boxes per year at a per unit price of $68. Variable selling and administrative costs of $4 per unit will be incurred if the tackle boxes are purchased from Craig Products.

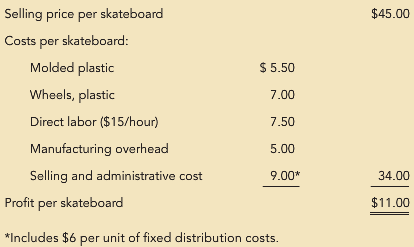

Bart Johnson, Avery€™s product manager, has suggested that the company could make better use of its plastics department by purchasing the tackle boxes and manufacturing skateboards. To support his position, Johnson has a market study that indicates an expanding market for skateboards and a need for additional suppliers. Johnson believes that Avery could expect to sell 17,500 skateboards annually at a price of $45.00 per skateboard. Johnson€™s estimate of the costs to manufacture the skateboards is as follows:

In the plastics department, Avery uses direct labor hours as the application base for manufacturing overhead. Included in the manufacturing overhead for the current year is $50,000 factory-wide, fixed manufacturing overhead that has been allocated to the plastics department.

Required

A. Define the problem faced by Avery based on the facts as presented.

B. What are the relevant objectives in this problem?

C. What options are available to Avery in solving the problem?

D. Rank the options in order of preference.

E. What qualitative factors should Avery consider in the decision?

F. Should Avery consider the potential liability that comes with selling skateboards? It has been shown that skateboards are responsible for 25 deaths per year and more than 500 serious accidents. Would that change your decision to make skateboards?

Step by Step Answer:

Managerial Accounting A Focus on Ethical Decision Making

ISBN: 978-0324663853

5th edition

Authors: Steve Jackson, Roby Sawyers, Greg Jenkins