Cain Company has an automated production process; consequently, it uses machine hours to describe production activity. The

Question:

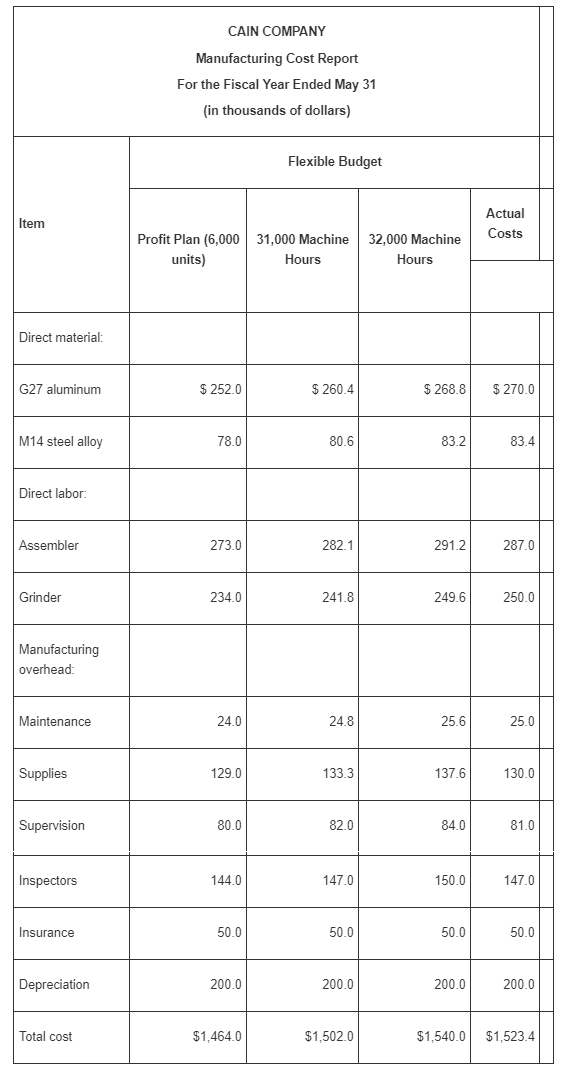

Cain Company has an automated production process; consequently, it uses machine hours to describe production activity. The company employs a full absorption cost system. The annual profit plan for the coming fiscal year is finalized each April. The profit plan for the fiscal year ending May 31 called for production of 6,000 units, requiring 30,000 machine hours. The full absorption cost rate for the fiscal year was determined using 6,000 units of planned production. Cain develops flexible budgets for different levels of activity to use in evaluating performance. During the fiscal year, Cain produced 6,200 units requiring 32,000 machine hours. The following schedule compares Cain Company’s actual costs for the fiscal year with the profit plan and the budgeted costs at two different activity levels:

| Budgeted information for the year: | ||

| Units (volume) | 6,000 | |

| Machine Hours (MH) | 30,000 | |

| Actual results for the year: | ||

| Units (volume) | 6,200 | |

| Machine Hours (MH) | 32,000 | |

Required

Compute these:

1. The actual cost of material used per unit of product produced this year.

2. The standard materials cost per machine hour.

3. The budgeted direct labor cost for each unit produced.

4. The standard variable overhead rate per machine hour.

5. The production-volume variance for the current year. Can you suggest an improved method for determining the fixed overhead allocation rate?

6. The total overhead spending variance for the year.

7. The total budgeted manufacturing cost for an output of 6,050 units.

8. Comment on how individual fixed overhead items are controlled on a day-to-day basis. How are individual variable overhead items controlled from day-to-day?

Step by Step Answer:

Cost management a strategic approach

ISBN: 978-0073526942

5th edition

Authors: Edward J. Blocher, David E. Stout, Gary Cokins