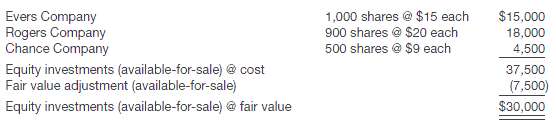

Castleman Holdings, Inc. had the following available for- sale investment portfolio at January 1, 2012. During 2012,

Question:

Castleman Holdings, Inc. had the following available for- sale investment portfolio at January 1, 2012.

During 2012, the following transactions took place.1. On March 1, Rogers Company paid a $2 per share dividend.2. On April 30, Castleman Holdings, Inc. sold 300 shares of Chance Company for $11 per share.3. On May 15, Castleman Holdings, Inc. purchased 100 more shares of Evers Co. stock at $16 per share.4. At December 31, 2012, the stocks had the following price per share values: Evers $17, Rogers $19, and Chance $8. During 2013, the following transactions took place.5. On February 1, Castleman Holdings, Inc. sold the remaining Chance shares for $8 per share.6. On March 1, Rogers Company paid a $2 per share dividend.7. On December 21, Evers Company declared a cash dividend of $3 per share to be paid in the next month.8. At December 31, 2013, the stocks had the following price per shares values: Evers $19 and Rogers $21.Instructions(a) Prepare journal entries for each of the above transactions.(b) Prepare a partial balance sheet showing the investment-related amounts to be reported at December 31, 2012 and2013.

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer: