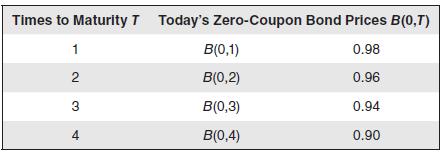

Compute the yield curve for the following zero- coupon bond prices. Times to Maturity T Today's Zero-Coupon

Question:

Compute the yield curve for the following zero- coupon bond prices.

Times to Maturity T Today's Zero-Coupon Bond Prices B(O,T) 2 3 4 B(0,2) B(0,3) B(0,4) 0.98 O.»5 0.94 0.90

Step by Step Answer:

The yield R0T at time zero today is defined by the expression B0T 1 1 R0T T Whe...View the full answer

An Introduction to Derivative Securities Financial Markets and Risk Management

ISBN: 978-0393913071

1st edition

Authors: Robert A. Jarrow, Arkadev Chatterjee

Related Video

Bond valuation is the process of determining the worth of a bond. It is based on the present value of the bond\'s future cash flows, which include coupon payments and the return of the bond\'s face value (or \"principal\") at maturity. The discount rate used in the calculation is directly tied to prevailing interest rates, and a rise in interest rates will decrease the present value of the bond and thus lower its price. Conversely, a fall in interest rates will increase the present value of the bond and raise its price. Interest rates serve as a benchmark for determining the value of a bond, as they determine the discount rate used in the bond valuation calculation. The most commonly used measure of interest rates is the yield to maturity (YTM), which represents the internal rate of return of an investment in a bond if the investor holds the bond until maturity and receives all scheduled payments. Yield to maturity is a function of the coupon rate, the current market price of the bond, the face value of the bond, and the number of years remaining until maturity. By comparing the yield to maturity of a bond to prevailing market interest rates, an investor can assess the relative value of the bond.

Students also viewed these Banking questions

-

Compute the forward rates and yields for the following zero- coupon bond prices. Times to Maturity T Today's Zero-Coupon Bond Prices B(0,T) B(0,2) 0.90 0.88 0.85

-

The following exercise is based on a series of investments made in 1993 by City Colleges of Chicago (CCC), a system of community colleges. Its treasurer decided to invest up to 70% of its portfolio...

-

Anthony has a choice of one of two bonds to purchase: a 5-year, $1,000 face value bond with 6% coupons, paid semiannually, or a 5-year, $1,000 face value zero coupon. Both have a yield to maturity of...

-

Classify each of the following items as a public good, a private good, a mixed good, or a common resource. Georges Banks cod stock A courtside seat at the U.S. Open (tennis) A well-stocked buffet...

-

The new tire you bought for your car is guaranteed to last an average of 25,000 kilometres. Your new tire wears prematurely, so you talk the tire store owner into surveying a random sample of 19...

-

Jake Corporation issued 1,000 shares of stock. Instructions Prepare the entry for the issuance under the following assumptions. (a) The stock had a par value of $5 per share and was issued for a...

-

Describe how an investor would hold an arbitrage position in an asset, in terms of full-hedge arbitrage.

-

Castillo Company reported these figures for 2014 and 2013: Requirements 1. Compute Castillo Company's earnings per share for 2014. Assume the company paid the minimum preferred dividend during 2014....

-

One year ago, your company purchased a machine used in manufacturing for $ 1 2 0 comma 0 0 0 . You have learned that a new machine is available that offers many advantages; you can purchase it for $...

-

The management of Brinkley Corporation is interested in using simulation to estimate the profit per unit for a new product. The selling price for the product will be $45 per unit. Probability...

-

What is the relation between an FRA rate for a contract that matures at time T and a forward rate of interest for time T 1?

-

How does the bonds yield relate to an internal rate of return? Is the bonds yield a good mea sure for its expected return over the next year?

-

The accompanying file contains ten years of quarterly data for the time series y along with the time variable, t, and dummy variables for each quarter, d i . Estimate a linear trend model with...

-

Please help. I would really appreciate it. Question 1. Polly owns an electric power plant in the city of Newtown. The market price of electricity in Newtown is $1.00 per kilowatt hour (kwh). Polly's...

-

(Appendix 3A) Jenson Manufacturing is developing cost formula for future planning and cost control. Utilities is one of the mixed costs associated with production. The cost analyst has suggested that...

-

A company has the following trial balance as at 31 December 2015: TRIAL BALANCE AS AT 31 DEC 2015 Dr Cr Sales Revenue 125 000 Purchases 78 000 Carriage 4 000 Electricity and rent 5 100 Administrative...

-

What gets printed to the screen by the following segment of code? String str1 = "hello"; String str2 = "world"; if (!strl.equals(str2)) { System.out.println(str1+" "+str2); } else { }...

-

a) Consider the following financial data (in millions of dollars) for Costello Laboratories over the period of 2014-2018: Year Sales Net income Total assets Common equity 2014 $3,800 $500 $3,900...

-

Prepare a feasibility analysis matrix, using the candidate solutions you identified and described in the preceding question. Use Figure 10-9 as your template, but choose the weighting factors that...

-

Diamond Walker sells homemade knit scarves for $25 each at local craft shows. Her contribution margin ratio is 60%. Currently, the craft show entrance fees cost Diamond $1,500 per year. The craft...

-

Worldwide Communications, Incorporated, sells telecommunication products throughout the world in three sales territories: Europe, Asia, and the Americas. For July, all \($650,000\) of administrative...

-

Chequers State Bank loans $50 million from its reserve account at the Federal Reserve Bank of Philadelphia to First National Bank of Smithville, located in the New York Federal Reserve Bank's...

-

Hillside Savings Association has an excess balance of $35 million in a deposit at its principal correspondent, Sterling City Bank, and instructs the latter institution to loan the funds today to...

-

Compare and contrast Fed funds transactions with RPs.

-

Bought an old van for 4000 from Peters promising to pay laterwhat is the transactions

-

Company has a following trade credit policy 1/10 N45. If you can borrow from a bank at 9,5% annual rate, would it be beneficial to borrow money and pay off invoices earlier?

-

Given the following exchange rates, which of the multiple-choice choices represents a potentially profitable inter-market arbitrage opportunity? 129.87/$1.1226/$0.00864/ 114.96/ B $0.8908/ (C)...

Study smarter with the SolutionInn App