Consider a different financing scenario for the solar water heater project discussed in Section 19.4. The project

Question:

Consider a different financing scenario for the solar water heater project discussed in Section 19.4. The project requires $10 million and has a base-case NPV of $170,000. Suppose the firm happens to have $5 million banked that could be used for the project. The government, eager to encourage solar energy, offers to help finance the project by lending $5 million at a subsidized rate of 5 percent. The loan calls for the firm to pay the government $647,500 annually for 10 years (this amount includes both principal and interest).

(a)?What is the value of being able to borrow from the government at 5 percent? Assume the company?s normal borrowing rate is 8 percent and the corporate tax rate is 35 percent.

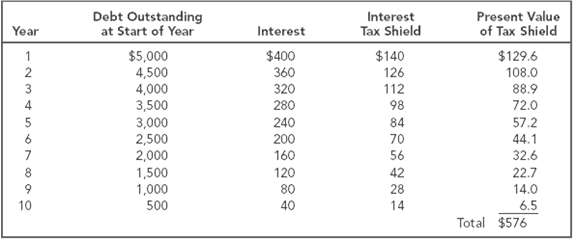

(b) Suppose the company?s normal debt policy is to borrow 50 percent of the book value of its assets. It calculates the present value of interest tax shields by the procedure shown in Table 19.1 and includes this present value in APV. Should it do so here, given the government?s offer of cheap financing?

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers