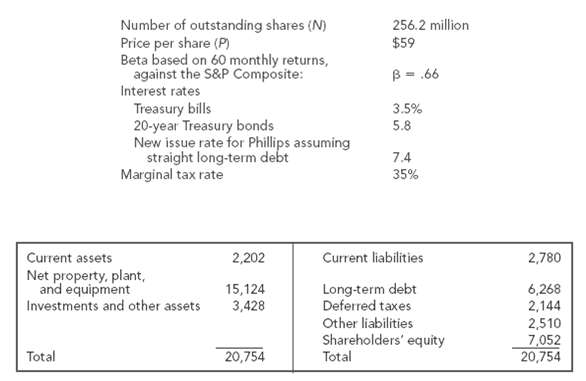

Table 19.4 is a simplified book balance sheet for Phillips Petroleum in June 2001. Other information: (a)

Question:

Table 19.4 is a simplified book balance sheet for Phillips Petroleum in June 2001. Other information:

(a)?Calculate Phillips?s WACC. Use the capital asset pricing model and the data given above. Make additional assumptions and approximations as necessary.

(b)?What would Phillips?s WACC be if it moved to and maintained a debt?market value ratio (D/V) of 25 percent?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Capital Asset Pricing Model

The Capital Asset Pricing Model (CAPM) describes the relationship between systematic risk and expected return for assets, particularly stocks. The CAPM is a model for pricing an individual security or portfolio. For individual securities, we make use of the security market line (SML) and its...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers

Question Posted: