Consider the following balance sheets for two hypothetical financial institutions, bank B and bank C: Bank Bs

Question:

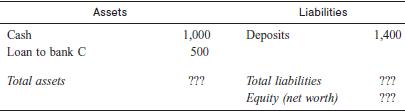

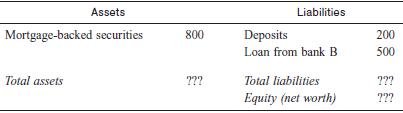

Consider the following balance sheets for two hypothetical financial institutions, bank B and bank C:

Bank B’s Balance Sheet

Bank C’s Balance Sheet

(a) Fill in the missing entries in the balance sheets (denoted ???).

(b) What is the leverage ratio in each bank?

(c) Suppose housing prices fall sharply and the mortgage-backed securities held by bank C fall in value to only $500. What happens to bank C’s net worth?

(d) The shortfall in bank C’s equity means that it cannot repay the loan it received from bank B. Assume bank C pays back as much as it can, while still making good on its deposits. What happens to the net worth of bank B?

(e) Discuss briefly how this is related to systemic risk.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: