Data for the investment centres for Stahl Company are given in BE11-9. The centres expect the following

Question:

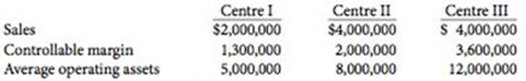

Data for the investment centres for Stahl Company are given in BE11-9. The centres expect the following changes in the next year: Centre I a 15% increase in sales; Centre II a $200,000 decrease in costs; and Centre III a $400,000 decrease in average operating assets. Calculate the expected return on investment for each centre. Assume Centre I has a contribution margin percentage of 75%.

Contribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes... Expected Return

The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return (RoR). It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting Tools for Business Decision Making

ISBN: 978-1118856994

4th Canadian edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso, Ibrahim M. Aly

Question Posted: