Dodge City Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted

Question:

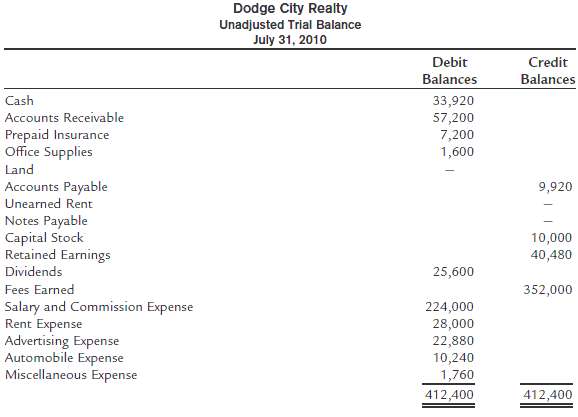

Dodge City Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 2010, is shown below.

The following business transactions were completed by Dodge City Realty during August 2010:Aug. 1 Purchased office supplies on account, $2,100.2 Paid rent on office for month, $4,000.3 Received cash from clients on account, $44,600.5 Paid annual insurance premiums, $5,700.9 Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, $400.17 Paid advertising expense, $5,500.23 Paid creditors on account, $4,950.29 Paid miscellaneous expenses, $500.30 Paid automobile expense (including rental charges for an automobile), $1,500.31 Discovered an error in computing a commission; received cash from the salesperson for the overpayment, $1,000.31 Paid salaries and commissions for the month, $27,800.31 Recorded revenue earned and billed to clients during the month, $83,000.31 Purchased land for a future building site for $75,000, paying $10,000 in cash and giving a note payable for the remainder.31 Paid dividends, $5,000.31 Rented land purchased on August 31 to a local university for use as a parking lot during football season (September, October, and November); received advance payment of $3,600.Instructions1. Record the August 1, 2010 balance of each account in the appropriate balance column of a T account, and write Balance to identify the opening amounts.2. Journalize the transactions for August in a two-column journal.3. Post the journal entries to the T accounts, placing the date to the left of each amount to identify the transaction. Determine the balances for all accounts with more than one posting.4. Prepare a trial balance of the ledger as of August 31,2010.

Step by Step Answer: