Don Cameron operates Hockey Facilities as a sole proprietorship. The operations consist of two retail outlets that

Question:

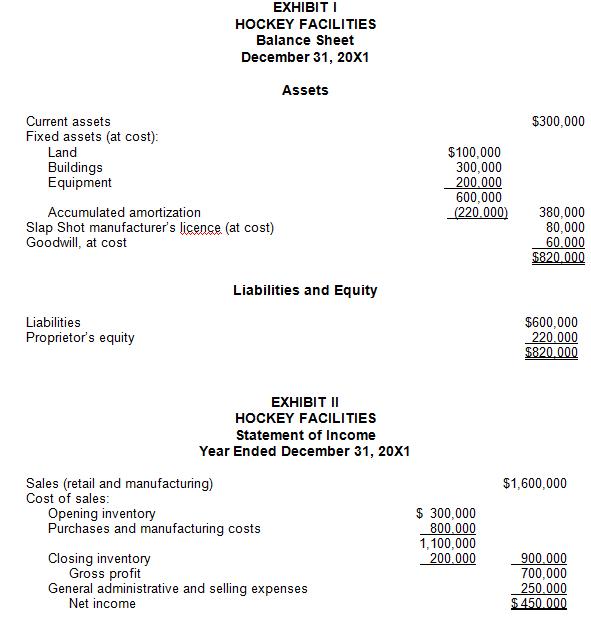

Don Cameron operates Hockey Facilities as a sole proprietorship. The operations consist of two retail outlets that sell all types of hockey equipment, as well as a separate manufacturing facility that manufactures the famous Slap Shot hockey stick. Financial information for the most recent 12-month period is outlined in Exhibits I and II on the following pages. In addition to the income derived from Hockey Facilities, Cameron has substantial investments that generate high returns. The investment income by itself has put Cameron in the top marginal tax bracket of 45%.That income consists of dividends from shares of public corporations and interest on bonds.

As the proprietor, Cameron draws funds from Hockey Facilities to pay his personal expenses and income taxes. He usually requires $40,000 annually for living expenses exclusive of any income taxes. You have recently met with Cameron to discuss the possibility of incorporating Hockey Facilities’ business operations. At the meeting, Cameron provided you with the following additional information:

1. Expected profits from Hockey Facilities are as follows:

20X2 ………………………………….. | $475,000 |

20X3 ………………………………….. | 520,000 |

20X4 ………………………………….. | 570,000 |

2. The assets described in the attached balance sheet have the following current fair market values:

Current assets ………………………………….. | $300,000 |

Land ………………………………….. | 150,000 |

Buildings ………………………………….. | 400,000 |

Equipment ………………………………….. | 100,000 |

Licence ………………………………….. | 120,000 |

Goodwill ………………………………….. | 200,000 |

3. The undepreciated capital cost of depreciable property at December 31, 20X1, after current capital cost allowance, is as follows:

Buildings ………………………………….. | $240,000 |

Equipment ………………………………….. | 90,000 |

Licence ………………………………….. | 70,000 |

4. The cumulative eligible capital account at December 31, 20X1, amounted to $22,000 after the 20X1 deduction.

5. The financial statements include amortization at an amount equal to the available capital cost allowance.

6. Cameron does not have a detailed breakdown of manufacturing profits and retail profits, although he estimates the retail profits to be $100,000.

Cameron is confused about how a corporate structure would be worthwhile and is concerned that, according to what he had heard, double taxation might result in certain circumstances.

Cameron’s son Eric is 23 years old and is actively involved in the business, earning a salary of $20,000 annually. Eric has spent most of his time at the manufacturing plant but intends to become involved in the retail operations as well. Cameron looks at the manufacturing activity as a separate business from the retail operation.

The meeting ended with you agreeing to provide a report to Cameron on the issues discussed.

Required:

Prepare the report, together with any supporting calculations and analyses you feel are necessary.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Canadian Income Taxation Planning And Decision Making

ISBN: 9781259094330

17th Edition 2014-2015 Version

Authors: Joan Kitunen, William Buckwold