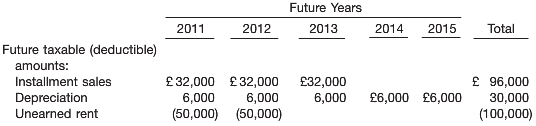

During 2010, Graham Co.s first year of operations, the company reports pretax financial income of £250,000. Grahams

Question:

Instructions

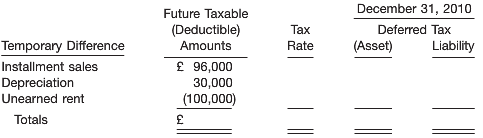

(a) Complete the schedule below to compute deferred taxes at December 31, 2010.

(b) Compute taxable income for 2010.

(c) Prepare the journal entry to record income tax payable, deferred taxes, and income tax expense for 2010.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 978-0470616314

IFRS edition volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted: