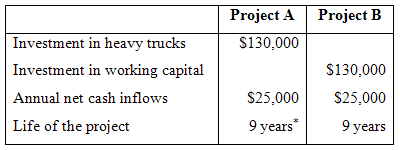

Dwyer Company is considering two investment projects. Relevant cost and cash flow information on the two projects

Question:

Dwyer Company is considering two investment projects. Relevant cost and cash flow information on the two projects is given below:

The trucks would have a $15,000 salvage value in nine years. For tax purposes, the company computes depreciation deductions assuming zero salvage value and uses straight-line depreciation. The trucks will be depreciated over five years. At the end of nine years, the working capital will be released for use elsewhere. The company requires an after-tax return of 12% on all investments. The tax rate is 30%.

Required:

Compute the net present value of each investment project. Round to the nearest whole dollar.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

Question Posted: