The Diamond Freight Company has been offered a seven-year contract to haul munitions for the government. Since

Question:

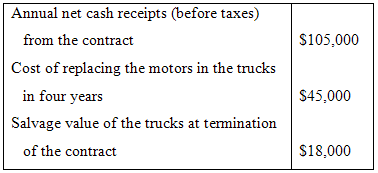

The Diamond Freight Company has been offered a seven-year contract to haul munitions for the government. Since this contract would represent new business, the company would have to purchase several new heavy-duty trucks at a cost of $350,000 if the contract were accepted. Other data relating to the contract follow:

With the motors being replaced after four years, the trucks will have a useful life of seven years. To misc money to assist in the purchase of the new trucks, the company will sell several old, fully depreciated trucks for a total selling price of $16,000. The company requires a 16% after-tax return n all equipment purchases. The tax rate is 30%. For tax purposes, the company computes deprecation deductions assuming zero salvage value and using straight-line depreciation. The new trucks would be depreciated over five years.

Required:

Compute the net present value of this investment opportunity. Round all dollar amounts to the nearest whole dollar. Would you recommend that the contract be accepted?

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at...

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer