EnterTech has noticed a significant decrease in the profitability of its line of portable CD players. The

Question:

EnterTech has noticed a significant decrease in the profitability of its line of portable CD players. The production manager believes that the source of the trouble is old, inefficient equipment used to manufacture the product. The issue raised, therefore, is whether EnterTech should (1) buy new equipment at a cost of $120,000 or (2) continue using its present equipment.

It is unlikely that demand for these portable CD players will extend beyond a five-year time horizon. EnterTech estimates that both the new equipment and the present equipment will have a remaining useful life of five years and no salvage value.

The new equipment is expected to produce annual cash savings in manufacturing costs of $34,000, before taking into consideration depreciation and taxes. However, management does not believe that the use of new equipment will have any effect on sales volume. Thus, its decision rests entirely on the magnitude of the potential cost savings. The old equipment has a book value of $100,000. However, it can be sold for only $20,000 if it is replaced. EnterTech has an average tax rate of 40 percent and uses straight-line depreciation for tax purposes. The company requires a minimum return of 12 percent on all investments in plant assets.

a. Compute the net present value of the new machine using the tables in Exhibits 26–3 and 26–4.

b. What nonfinancial factors should EnterTech consider?

c. If the manager of EnterTech is uncertain about the accuracy of the cost savings estimate, what actions could be taken to double-check the estimate?

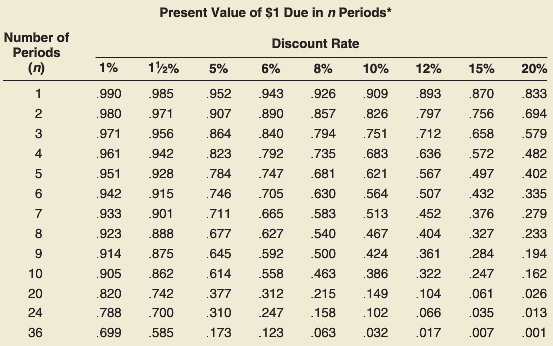

In Exhibits 26–3

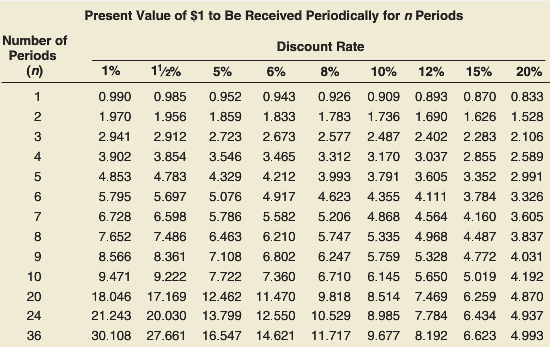

In Exhibits 26–4

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Financial and Managerial Accounting the basis for business decisions

ISBN: 978-0078111044

16th edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello