Question: Fire Loss, computing inventory costs a distraught employee, Fang W. Arson, put a torch to a manufacturing plant on a blustery February 26. The resulting

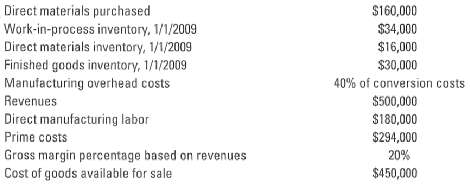

Fire Loss, computing inventory costs a distraught employee, Fang W. Arson, put a torch to a manufacturing plant on a blustery February 26. The resulting blaze destroyed the plant and its contents. Fortunately, certain accounting records were kept in another building. They reveal the following for the period from

The loss is fully covered by insurance. The insurance company wants to know the historical cost of the inventories as a basis for negotiating a settlement although the settlement is actually to be based on replacement cost, not historical cost

Calculate the cost of:

1. Finished goods inventory, 2/26/2009

2. Work-in-process inventory, 2/26/2009

3. Direct materials inventory,2/26/2009

Direct materials purchased $160,000 $34,000 $16,000 Work-in-process inventory, 1/1/2009 Direct materials inventory, 1/1/2009 Finished goods inventory, 1/1/2009 Manufacturing overhead costs Revenues $30,000 40% of conversion costs $500,000 $180,000 Direct manufacturing labor Prime costs $294,000 Gross margin percentage based on revenues Cost of goods available for sale 20% $450,000

Step by Step Solution

3.45 Rating (177 Votes )

There are 3 Steps involved in it

Fire loss computing inventory costs 1 Finished goods inventory 2262009 50000 2 Workinprocess inventory 2262009 28000 3 Direct materials inventory 2262... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

24-B-C-A-A-R (68).docx

120 KBs Word File