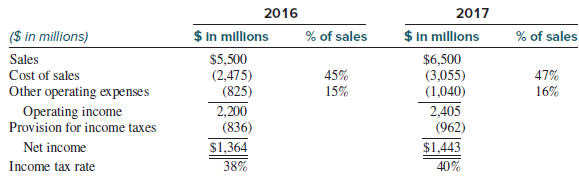

Following are income statements for Hossa Corporation for 2017 and 2016. Percentage of sales amounts are also

Question:

Following are income statements for Hossa Corporation for 2017 and 2016. Percentage of sales amounts are also shown for each operating expense item. Hossa’s income tax rate was 38% in 2016 and 40% in 2017.

Hossa’s management was pleased that 2017 net income was up 5.8% from the prior year. Although you are also happy with the increase in net income, you are not so sure the news is all positive. You have modeled Hossa’s income as follows:

NET INCOME = SALES × (1 − COGS % − OPEX %) × (1 − TAX RATE)

Using this model, net income in 2016 is computed as $5,500 × (1 − 45% − 15%) × (1 − 38%) = $1,364. Net income in 2017 is computed as $6,500 × (1 − 47% − 16%) × (1 − 40%) = $1,443.

Required:

1. Prepare a cause-of-change analysis to show the extent to which each of the following items contributed to the $79 million increase in Hossa’s net income from 2016 to 2017:

• Increase in sales (SALES)

• Increase in cost of sales as a percent of sales (COGS%)

• Increase in other operating expenses as a percent of sales (OPEX%)

• Increase in income tax rate (TAX RATE)

2. Interpret the results for Hossa’s management.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Financial Reporting and Analysis

ISBN: 978-1259722653

7th edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer