Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Two companies (A and B) are duopolists that produce identical products. Demand for the products is given by the following demand function: P

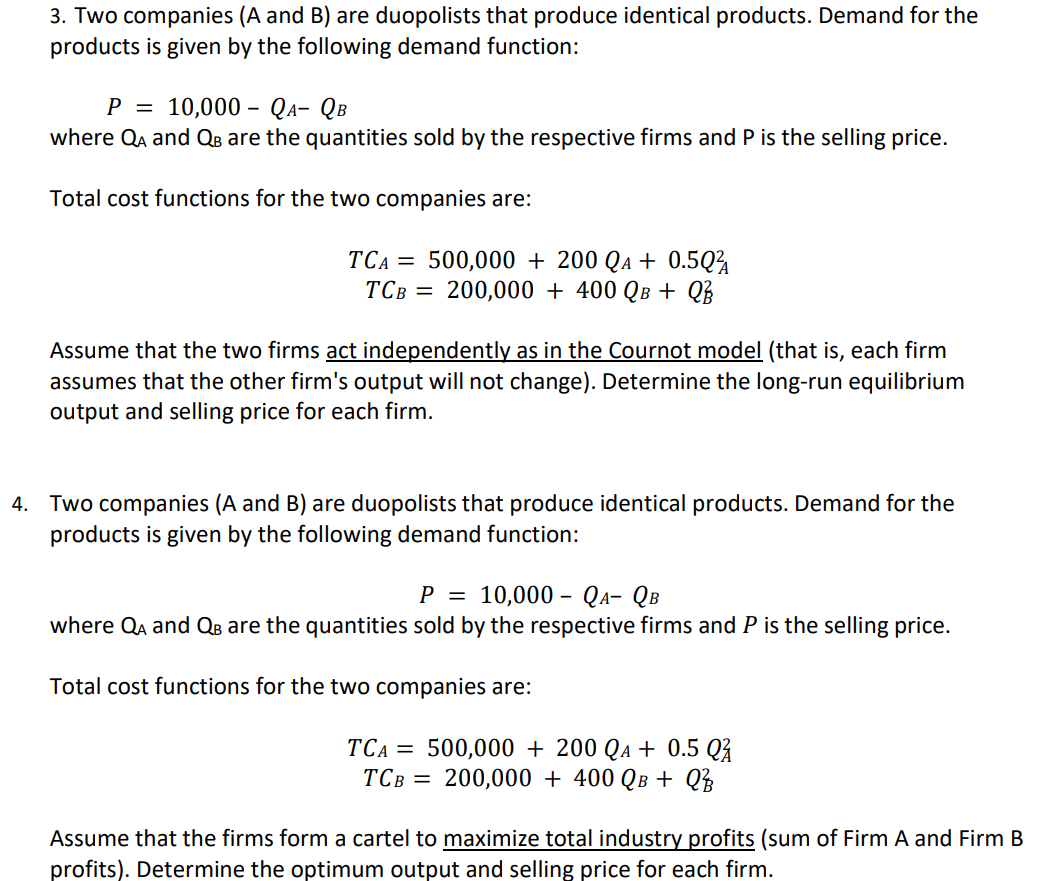

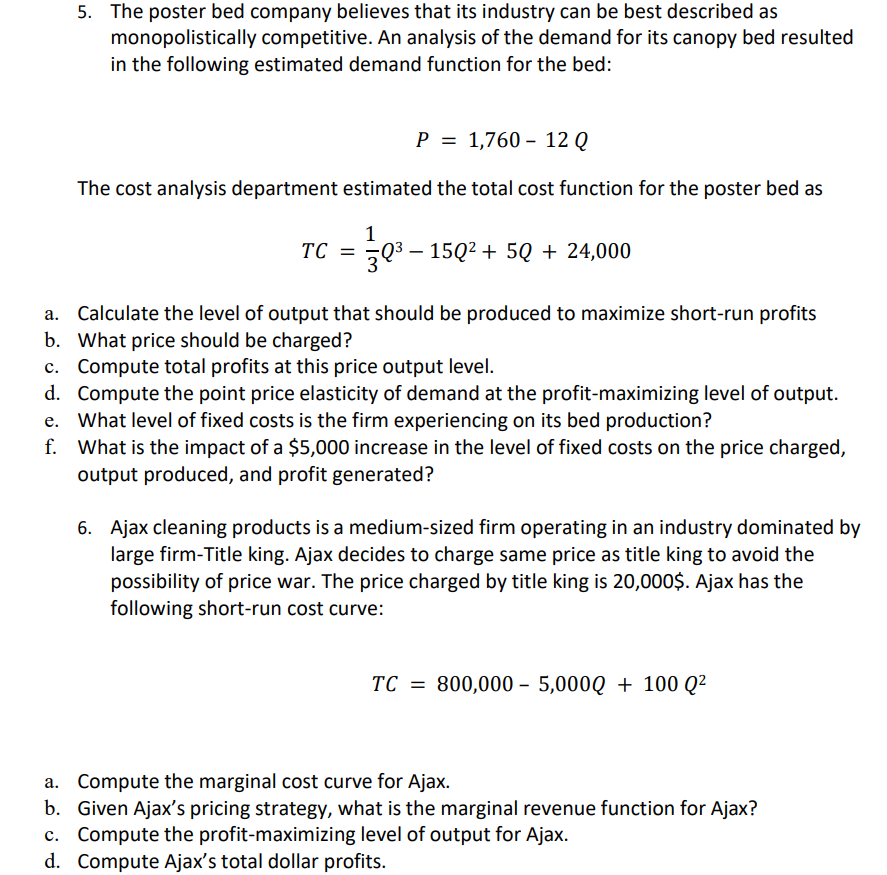

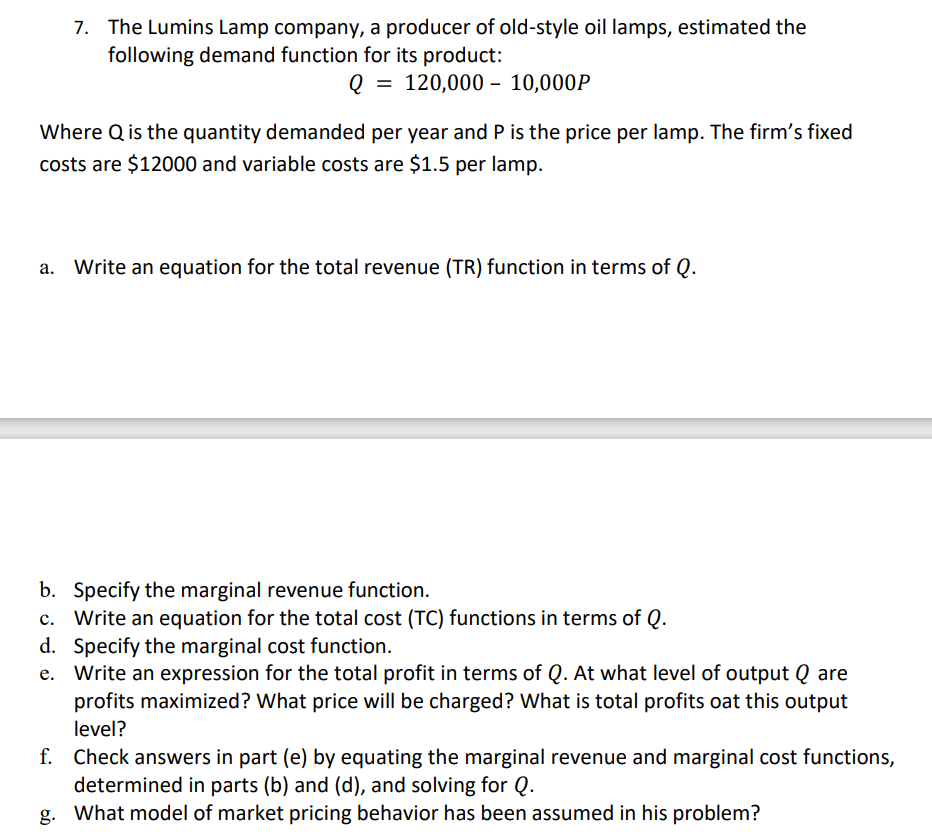

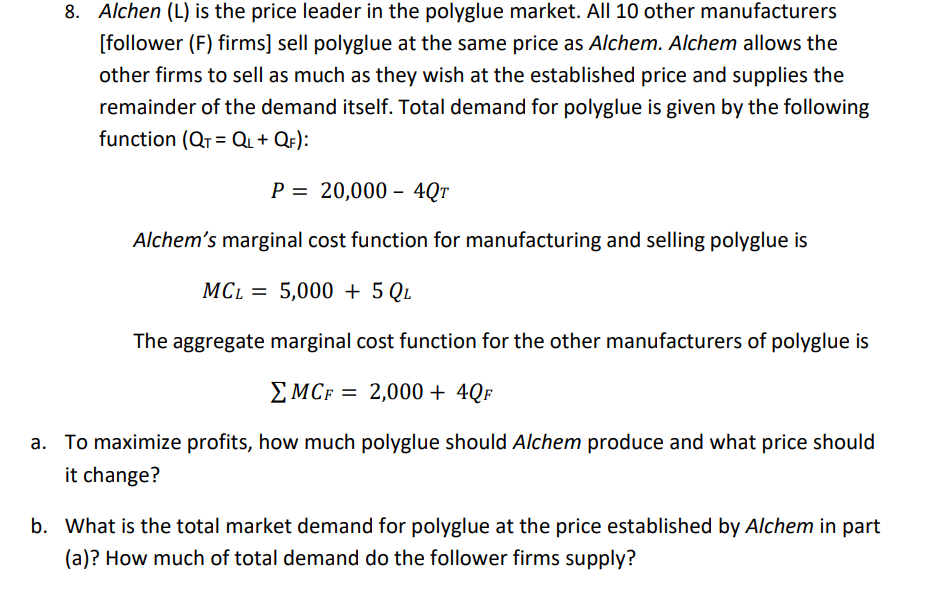

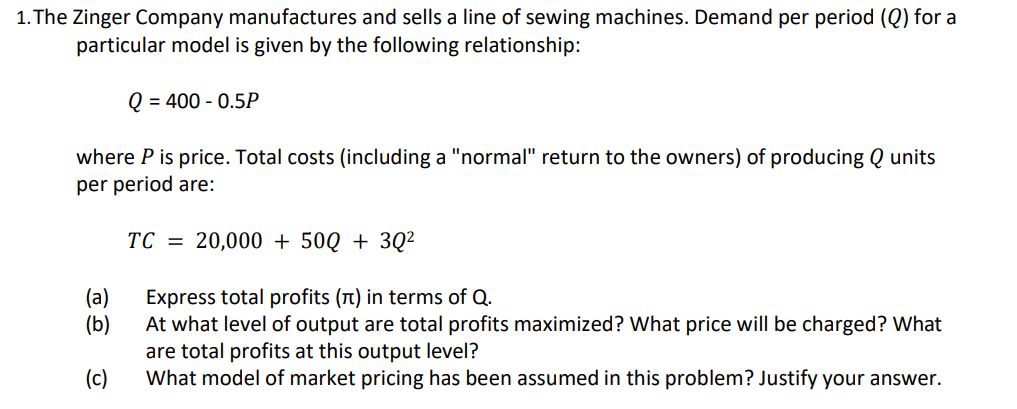

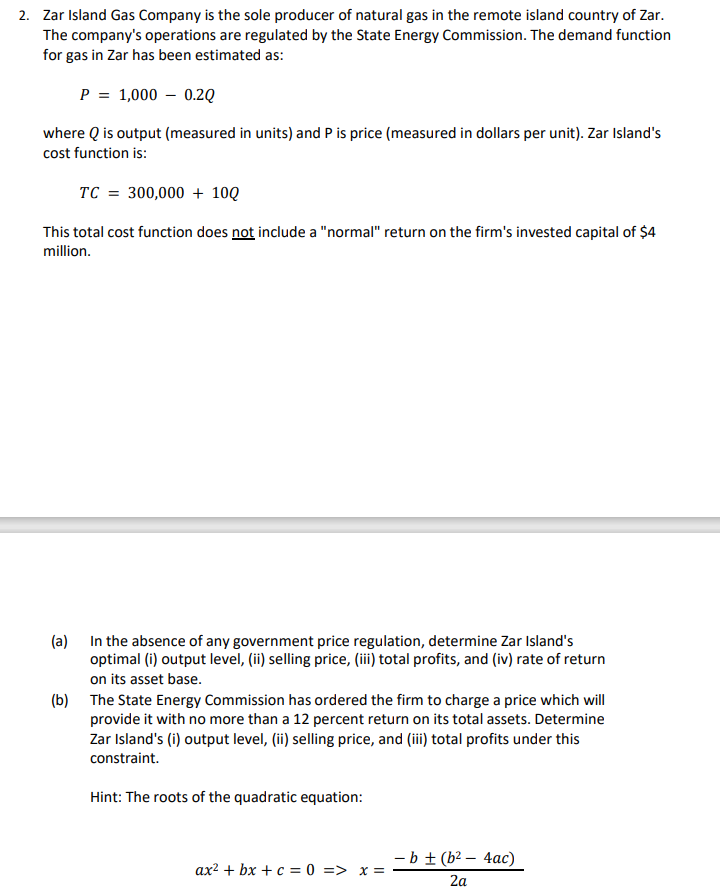

3. Two companies (A and B) are duopolists that produce identical products. Demand for the products is given by the following demand function: P = 10,000 QA- QB - where QA and QB are the quantities sold by the respective firms and P is the selling price. Total cost functions for the two companies are: TCA = 500,000 + 200 QA + 0.502A TCB = 200,000+ 400 QB + Q Assume that the two firms act independently as in the Cournot model (that is, each firm assumes that the other firm's output will not change). Determine the long-run equilibrium output and selling price for each firm. 4. Two companies (A and B) are duopolists that produce identical products. Demand for the products is given by the following demand function: P = 10,000- QA- QB where QA and QB are the quantities sold by the respective firms and P is the selling price. Total cost functions for the two companies are: TCA = 500,000 + 200 QA + 0.5 Q TCB=200,000 + 400 QB + Q Assume that the firms form a cartel to maximize total industry profits (sum of Firm A and Firm B profits). Determine the optimum output and selling price for each firm. 5. The poster bed company believes that its industry can be best described as monopolistically competitive. An analysis of the demand for its canopy bed resulted in the following estimated demand function for the bed: P1,760 12 Q The cost analysis department estimated the total cost function for the poster bed as 1 TC = 30 - 150 + 50 + 24,000 15Q2 5Q a. Calculate the level of output that should be produced to maximize short-run profits b. What price should be charged? c. Compute total profits at this price output level. d. Compute the point price elasticity of demand at the profit-maximizing level of output. e. What level of fixed costs is the firm experiencing on its bed production? f. What is the impact of a $5,000 increase in the level of fixed costs on the price charged, output produced, and profit generated? 6. Ajax cleaning products is a medium-sized firm operating in an industry dominated by large firm-Title king. Ajax decides to charge same price as title king to avoid the possibility of price war. The price charged by title king is 20,000$. Ajax has the following short-run cost curve: TC = 800,000 - 5,000Q + 100 Q a. Compute the marginal cost curve for Ajax. b. Given Ajax's pricing strategy, what is the marginal revenue function for Ajax? c. Compute the profit-maximizing level of output for Ajax. d. Compute Ajax's total dollar profits. 7. The Lumins Lamp company, a producer of old-style oil lamps, estimated the following demand function for its product: Q = 120,000 10,000P Where Q is the quantity demanded per year and P is the price per lamp. The firm's fixed costs are $12000 and variable costs are $1.5 per lamp. Write an equation for the total revenue (TR) function in terms of Q. b. Specify the marginal revenue function. c. Write an equation for the total cost (TC) functions in terms of Q. d. Specify the marginal cost function. e. Write an expression for the total profit in terms of Q. At what level of output Q are profits maximized? What price will be charged? What is total profits oat this output level? f. Check answers in part (e) by equating the marginal revenue and marginal cost functions, determined in parts (b) and (d), and solving for Q. g. What model of market pricing behavior has been assumed in his problem? 8. Alchen (L) is the price leader in the polyglue market. All 10 other manufacturers [follower (F) firms] sell polyglue at the same price as Alchem. Alchem allows the other firms to sell as much as they wish at the established price and supplies the remainder of the demand itself. Total demand for polyglue is given by the following function (QT Q+ QF): P = 20,000 4QT Alchem's marginal cost function for manufacturing and selling polyglue is MCL=5,000 + 5 QL The aggregate marginal cost function for the other manufacturers of polyglue is MCF 2,000 + 4QF a. To maximize profits, how much polyglue should Alchem produce and what price should it change? b. What is the total market demand for polyglue at the price established by Alchem in part (a)? How much of total demand do the follower firms supply? 1. The Zinger Company manufactures and sells a line of sewing machines. Demand per period (Q) for a particular model is given by the following relationship: = 400 - 0.5P where P is price. Total costs (including a "normal" return to the owners) of producing Q units per period are: (a) (b) (c) TC 20,000 + 50Q + 3Q Express total profits () in terms of Q. At what level of output are total profits maximized? What price will be charged? What are total profits at this output level? What model of market pricing has been assumed in this problem? Justify your answer. 2. Zar Island Gas Company is the sole producer of natural gas in the remote island country of Zar. The company's operations are regulated by the State Energy Commission. The demand function for gas in Zar has been estimated as: P = 1,000 0.2Q where Q is output (measured in units) and P is price (measured in dollars per unit). Zar Island's cost function is: TC = 300,000 + 10Q This total cost function does not include a "normal" return on the firm's invested capital of $4 million. (a) In the absence of any government price regulation, determine Zar Island's optimal (i) output level, (ii) selling price, (iii) total profits, and (iv) rate of return on its asset base. (b) The State Energy Commission has ordered the firm to charge a price which will provide it with no more than a 12 percent return on its total assets. Determine Zar Island's (i) output level, (ii) selling price, and (iii) total profits under this constraint. Hint: The roots of the quadratic equation: ax2 bx + c = 0 => x = -b(b2-4ac) 2a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the problem step by step and find the longrun equilibrium output and selling price f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started