For each entry in Table 2.5, explain the circumstances in which the maximum gain or loss occurs.

Question:

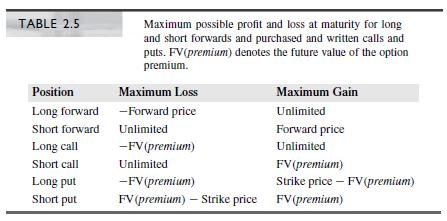

TABLE 2.5 Maximum possible profit and loss at maturity for long and short forwards and purchased and written calls and puts. FV(premium) denotes the future value of the option premium. Position Maximum Loss Maximum Gain Long forward -Forward price Unlimited Short forward Unlimited Forward price Long call -FV(premium) Unlimited Short call Unlimited FV(premium) Long put -FV(premium) Strike price – FV(premium) Short put FV (premium) – Strike price FV(premium)

Step by Step Answer:

a Long Forward The maximum loss occurs if the stock price at expiration is zero the stock price cannot be less than zero because companies have limite...View the full answer

Related Video

A put option is a financial contract that gives the owner the right, but not the obligation, to sell an underlying asset, such as a stock or a commodity, at a predetermined price, known as the strike price, on or before a specific date, known as the expiration date. Put options are used by investors as a form of insurance against a decline in the value of the underlying asset. If an investor expects the value of an asset to fall in the future, they can purchase a put option on that asset. If the value of the asset does fall, the put option will increase in value, allowing the investor to sell the asset at the higher strike price. For example, if an investor owns 100 shares of a stock that is currently trading at $50 per share, they may purchase a put option with a strike price of $45 and an expiration date three months in the future. If the stock price falls to $40 before the expiration date, the investor can exercise the put option and sell their shares for $45 each, even though the market price is only $40. This would allow the investor to limit their losses. It\'s important to note that purchasing a put option involves paying a premium to the seller of the option, and the investor can lose the entire premium if the price of the underlying asset does not decline as expected. Put options are just one type of financial derivative and should only be used by experienced investors who understand the risks involved.

Students also viewed these Corporate Finance questions

-

Explain the circumstances under which fair value hedge accounting should be used and when cash flow hedge accounting should be used.

-

Explain the circumstances under which debt financing will increase the return on common stockholders equity ratio.

-

Explain the circumstances under which an environmental impact statement must be filed, and describe the statement's required content.

-

If the demand during review cycle is equal to 12, the demand during lead time is 11, and the safety stock is equal to 8, what is the order point? What is the EOQ of an item with a project annual...

-

The life spans of a species of fruit fly have a bell-shaped distribution, with a mean of 33 days and a standard deviation of 4 days. (a) The life spans of three randomly selected fruit flies are 34...

-

CPAs R Us conducts CPA review courses. Public universities that permit free use of a classroom support the classes. The only major expense incurred by CPAs R Us is the salary of instructors, which is...

-

Quatro Corp. engages solely in manufacturing operations. The following data pertain to the operat ing segments for the current year: Operating LO3 Total Segment Revenues Profit Assets at 12/31 A. . ....

-

The accountant for a subunit of Anderson Sports Company went on vacation before completing the subunits monthly performance report. This is as far as she got: Requirements 1. Complete the performance...

-

1. Consider the following binomial option model. Stock price is 100 dollars now. In 1 year it can go to 120 dollars or 80 dollars. Interest rate with annual compounding is 10 percent. What is the...

-

For each of the following items, indicate whether it would appear on a materials requisition form (MRF), a direct labor time ticket (DLTT), and/or a job cost sheet (JCS). Note: An item may appear on...

-

For Figure 2.8, verify the following: a. The S&R index price at which the put option diagram intersects the x-axis is $924.32. b. The S&R index price at which the put option and forward contract have...

-

Suppose the stock price is $40 and the effective annual interest rate is 8%. a. Draw on a single graph payoff and profit diagrams for the following options: (i) 35-strike call with a premium of...

-

Use differentials to estimate the amount of metal in a closed cylindrical can that is 10 cm high and 4 cm in diameter if the metal in the top and bottom is 0.1 cm thick and the metal in the sides is...

-

Pulleys C and D in Figure are fastened together. Weights A and B are supported by ropes wound around the pulleys as shown. The radius for pulley C is 187 mm and the radius for pulley D is 138 mm. If...

-

As a leader what are some of the thoughtful and creative ideas that you have implemented to motivate your team and increase job satisfaction?

-

A Chinese smartphone maker TECNO Ltd has provided you with a summary of its price and cost information for one of its product segments (tablets). It is based on 2018 income statement. Units produced...

-

The following projected financial data is available for the single product of Janis Ltd:- October November December Sales (unit) 50,000 65,000 65,000 Production (unit) 70,000 60,000 50,000 Opening...

-

I would appreciate freehand sketches for the top, side views, and front views. D C 6 50 B 2.75 A a 5 4 3 2 1 .45 UNLESS OTHERWISE SPECIFIED: DIMENSIONS ARE IN MILLIMETERS SURFACE FINISH: TOLERANCES:...

-

The system of Figure P12.2 is one of the few for which an exact solution is available. Its solution is obtained in a manner analogous to that of free vibrations with Coulomb damping. The block is...

-

Fred Farmer needs to prepare a balance sheet for his bank. He spent the day getting the following information. Fred needs your help to build a balance sheet and evaluate it. The information was...

-

The drum diameter of a single-block brake is \(1 \mathrm{~m}\). It sustains \(240 \mathrm{Nm}\) of torque at \(400 \mathrm{rpm}\). The coefficient of friction is 0.32 . The distance of the fulcrum...

-

Compute estimated profit in 1 year if Telco buys paylater calls as follows (the net premium may not be exactly zero): a. Sell one 0.975-strike call and buy two 1.034-strike calls. b. Sell two...

-

Suppose that Wirco does nothing to manage the risk of copper price changes. What is its profit 1 year from now, per pound of copper? Suppose that Wirco buys copper forward at $1. What is its profit 1...

-

What happens to the variability of Wirco's profit if Wirco undertakes any strategy (buying calls, selling puts, collars, etc.) to lock in the price of copper next year? You can use your answer to the...

-

Dr. Claudia Gomez, a plastic surgeon, had just returned from a conference in which she learned of a new surgical procedure for removing wrinkles around eyes, reducing the time to perform the normal...

-

QUESTION 2 ( 2 0 Marks ) 2 . 1 REQUIRED Study the information provided below and prepare the Income Statement for the year ended 3 1 December 2 0 2 3 using the marginal costing method. INFORMATION...

-

DROP DOWN OPTIONS: FIRST SECOND THIRD FOURTH 5. Cost of new common stock A firm needs to take flotation costs into account when it is raising capital fromY True or False: The following statement...

Study smarter with the SolutionInn App