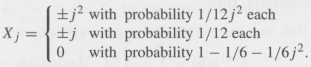

For j = 1,2 n, let Xj be independent r.v.s defined as follows: Then show that the

Question:

Then show that the Lindeberg condition (condition (12.24)) does not hold.

Recall that

![]()

and show that, for every É› > 0 and large n:

![]()

![]()

in order to conclude that

![]()

Transcribed Image Text:

+j? with probability 1/12 j? each X; = {+j with probability 1/12 each with probability 1 – 1/6 – 1/6j².

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (14 reviews)

We have X j 0 2 j 2 X j X 2 j j 4 112j 2 2 j 2 16 2 j 2 3 ...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

An Introduction to Measure Theoretic Probability

ISBN: 978-0128000427

2nd edition

Authors: George G. Roussas

Question Posted:

Students also viewed these Statistics questions

-

Let X and Y be independent r.v.s. and suppose that X exits. For very B ( B, let A = Y-1 (B) and show that (A XdP = (X) P (A).

-

Let X n , n ¥ 1, be independent r.v.s distributed as B (1, Ï ), and set Then show that And n- , . X,

-

Let X1, ..., Xn be independent r.v.s, each of which is symmetric about 0. Then the r.v. X1 + ... + Xn is also symmetric about 0.

-

Give the eccentricities of conic sections with one focus at the origin of the polar coordinate plane, along with the directrix for that focus. Find a polar equation for each conic section. e = 1/2, r...

-

What are some major reasons for departing from the standard, unqualified report on internal control over financial reporting?

-

What are two major goals of a job-costing system?

-

IMAs 2021 survey. For many years, the Institute of Management Accountants (IMA) has conducted a very popular survey of the salaries of its global members, enabling them to compare their compensation...

-

The cash account of Jose Orozco Co. showed a ledger balance of $3,969.85 on June 30, 2008. The bank statement as of that date showed a balance of $4,150. Upon comparing the statement with the cash...

-

Date June 1 Cornerstone Exercise 6-32 (Algorithmic) Inventory Costing Methods: Periodic Average Cost (Appendix 6B) Filimonov Inc. has the following information related to purchases and sales of one...

-

1. Prepare manual entries and complete the general and subsidiary ledgers. 2. Prepare an account receivable and account payable reconciliation of the subsidiary ledger accounts to the control...

-

Let the r.v.s Xj, j ¥ 1, be distributed as follows: Show that the Lindeberg condition (relation (12.24)) holds, if and only if α < 3/2. Conclude that For α < 3/2, show...

-

Let X n , n ¥ 1, be independent r.v.s such that |X n | ¤ M n a.s. with M n = o(s n ) where Set and snow that Hint: From the assumption M n = o(s n ) it follows that so that Mn <...

-

Discuss in detail the Interesting Aspects of Tourette's Life.

-

2vx Voy Ax g 2vo cos 0 sin 0 g vo sin(20) g

-

PORTAGE COLLEGE Diversity Awareness Course Score | Home | Help | Exit Module 2 Post-Test Module 1 Module 2 Module 3 Module 2 Post-Test Betsy really likes working at Thompson Trucking. She likes how...

-

Suppose f(x) = 5x cos x. Find the equation of the tangent line to f(x) at the point (, -5). y = x+

-

First, for this case study, define the ethical dilemma facing "John". Second, isn't the collectability of an account ultimately based on opinion? If so , how does that play in the ethical dilemma...

-

Does the game have a dominant-strategy equilibrium? If so, what is it and why is it that? If not, why not?

-

The forward path transfer function of a position control system with velocity feedback is given by \[ \mathrm{G}(s)=\frac{\mathrm{K}}{s(s+p)} \] Determine the sensitivity of the transfer function of...

-

3.16. For a system with non-identical service rates (see Sect. 3.5) and a limit of N jobs in the system (Eq. 3.13), obtain an expression for the mean service time per job, E[Ts], as a function of the...

-

Let P (A) = 0.70, P (B | A) = 0.55, and P (B | Ac) = 0.10. Use a probability tree to calculate the following probabilities: a. P (Ac) b. P (A B) and P (Ac B) c. P (B) d. P (A | B)

-

Let P (B) = 0.60, P (A | B) = 0.80, and P (A | Bc) = 0.10. Calculate the following probabilities: a. P (Bc) b. P (A B) and P (A Bc) c. P (A) d. P (B | A)

-

Complete the following probabilitytable. Prior Probability Probability Probability Probability Conditional Joint Posterior Total P(A) Total =

-

Compute the value of ordinary bonds under the following circumstances assuming that the coupon rate is 0.06:(either the correct formula(s) or the correct key strokes must be shown here to receive...

-

A tax-exempt municipal bond has a yield to maturity of 3.92%. An investor, who has a marginal tax rate of 40.00%, would prefer and an otherwise identical taxable corporate bond if it had a yield to...

-

Please note, kindly no handwriting. Q. Suppose a 3 year bond with a 6% coupon rate that was purchased for $760 and had a promised yield of 8%. Suppose that interest rates increased and the price of...

Study smarter with the SolutionInn App