For an outlay of $8 million you can purchase a tanker load of bucolic acid delivered in

Question:

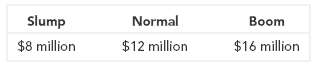

For an outlay of $8 million you can purchase a tanker load of bucolic acid delivered in Rotterdam one year hence. Unfortunately the net cash flow from selling the tanker load will be very sensitive to the growth rate of the world economy:

a. What is the expected cash flow? Assume the three outcomes for the economy are equally likely.

b. What is the expected rate of return on the investment in the project?

c. One share of stock Z is selling for $10. The stock has the following payoffs after one year:

Calculate the expected rate of return offered by stock Z. Explain why this is the opportunity cost of capital for your bucolic acid project.

d. Calculate the project's NPV. Is the project a good investment? Explain why.

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers