In real life the future health of the economy cannot be reduced to three equally probable states

Question:

In real life the future health of the economy cannot be reduced to three equally probable states like slump, normal, and boom. But we?ll keep that simplification for one more example. Your company has identified two more projects, B and C. Each will require a $5 million outlay immediately. The possible payoffs at year 1 are, in millions:

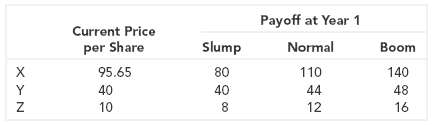

You have identified the possible payoffs to investors in three stocks, X, Y, and Z:

a. What are the expected cash inflows of projects B and C?

b. What are the expected rates of return offered by stocks X, Y, and Z?

c. What are the opportunity costs of capital for projects B and C?

X, Y, and Z. Match up to the percentage differences in B's and C's payoffs.

d. What are the NPVs of projects B and C?

e. Suppose B and C are launched and $5 million is invested in each. How much will they add to the total market value of your company's shares?

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers