Funds can be consolidated, but only at the risk of lost or misleading information. The balance sheet

Question:

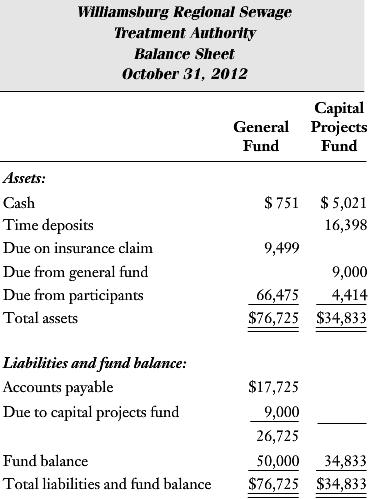

Funds can be €˜€˜consolidated,€™€™ but only at the risk of lost or misleading information. The balance sheet below was adapted from the financial statements of the Williamsburg Regional Sewage Treatment Authority (dates have been changed):

Fund Types

The transactions of the authority are accounted for in the following governmental fund types:

€¢ General fund€”To account for all revenues and expenditures not required to be accounted for in other funds.

€¢ Capital projects fund€”To account for financial resources designated to constructor acquire capital facilities and improvements. Such resources are derived principally from other municipal utility districts to which the Williamsburg Regional Sewage Treatment Authority provides certain services.

1. Recast the balance sheets of the two funds into a single consolidated balance sheet. Show separately, however, the restricted and the unrestricted portions of the consolidated fund balance account (not each individual asset and liability). Be sure to eliminate inter-fund payables and receivables.

2. Which presentation (the unconsolidated or the consolidated) provides more complete information? Explain. Which presentation might be seen as misleading? Why? What advantages, if any, do you see to the presentation that is less complete and more misleading?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Core Concepts of Government and Not For Profit Accounting

ISBN: 978-0471737926

2nd edition

Authors: Michael H. Granof, Penelope S. Wardlow