Answered step by step

Verified Expert Solution

Question

1 Approved Answer

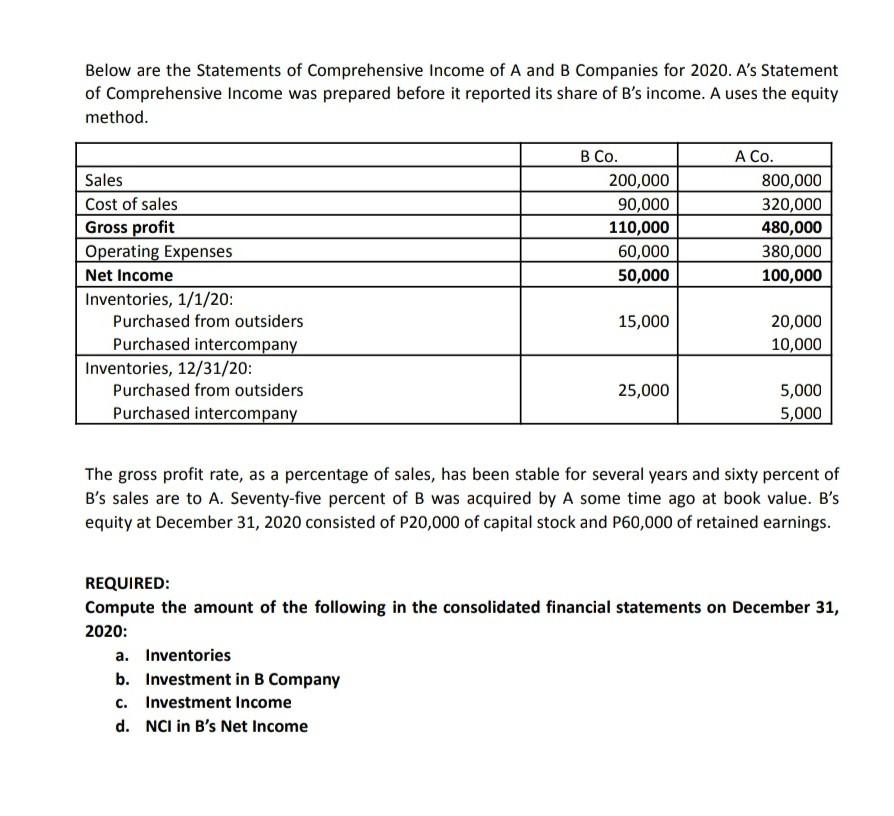

Below are the Statements of Comprehensive Income of A and B Companies for 2020. A's Statement of Comprehensive Income was prepared before it reported

Below are the Statements of Comprehensive Income of A and B Companies for 2020. A's Statement of Comprehensive Income was prepared before it reported its share of B's income. A uses the equity method. . A Co. Sales 200,000 Cost of sales Gross profit Operating Expenses 90,000 110,000 60,000 50,000 800,000 320,000 480,000 380,000 Net Income 100,000 Inventories, 1/1/20: Purchased from outsiders 15,000 20,000 Purchased intercompany 10,000 Inventories, 12/31/20: Purchased from outsiders 25,000 5,000 Purchased intercompany 5,000 The gross profit rate, as a percentage of sales, has been stable for several years and sixty percent of B's sales are to A. Seventy-five percent of B was acquired by A some time ago at book value. B's equity at December 31, 2020 consisted of P20,000 of capital stock and P60,000 of retained earnings. REQUIRED: Compute the amount of the following in the consolidated financial statements on December 31, 2020: a. Inventories b. Investment in B Company c. Investment Income d. NCI in B's Net Income

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Inventories as at 31122020 to be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started