Question: Given the representation: Can you determine the g(-) if the M T (X T ) is the payoff of an plain vanilla European call option

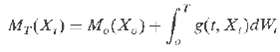

Given the representation:

Can you determine the g(-) if the MT(XT) is the payoff of an plain vanilla European call option at expiration?

That is, if MT(XT) is given by:

MT(XT) = max [XT?? K, 0],

Where 0

Mp(X,) = M,(X.)- g(t, X,)dW,

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

In theory the representation is possible The difficulty is that X t S t may not be a martingale u... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

41-B-F-F-M (32).docx

120 KBs Word File