Glover Chemical purchased 100 percent of the outstanding stock of Ward Supply on December 31 for $100,000

Question:

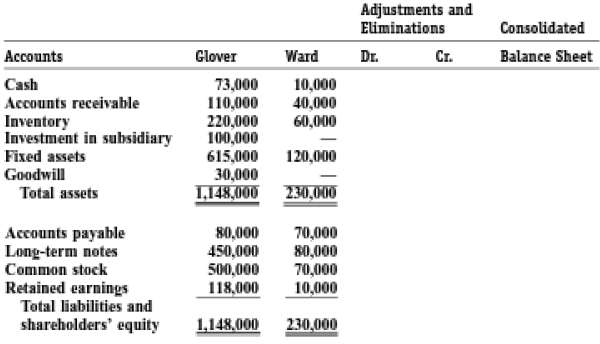

Glover Chemical purchased 100 percent of the outstanding stock of Ward Supply on December 31 for $100,000 cash. As of that date, the FMVs of the inventory and fixed assets of Ward equaled $70,000 and $125,000, respectively. Assume that information to complete the following consolidated work sheet, which already reflects the entry recorded at acquisition.

Adjustments and Eliminations Consolidated Dr. Cт. Accounts Glover Ward Balance Sheet Cash 73,000 110,000 220,000 100,000 615,000 30,000 1,148,000 230,000 10,000 40,000 60,000 Accounts receivable Inventory Investment in subsidiary Fixed assets Goodwill 120,000 Total assets 70,000 80,000 70,000 10,000 Accounts payable Long-term notes 80,000 450,000 500,000 118,000 Common stock Retained earnings Total liabilities and shareholders' equity 230,000 1,148.000

Step by Step Answer:

Adjustments and Eliminations Consolidated Accounts Glover Ward Debit Credit Balance Sheet Cash 73000 ...View the full answer

Related Video

This video is about ways to attempt consolidated balance sheet questions. since the unconsolidated financial statements of parent and subsidiary companies are prepared separately, consolidating the balance sheets of both companies is critical and sometimes becomes complex. the tutorial will guide students on to how questions on attempting questions on consolidated financial statements in an easier yet more effective way.

Students also viewed these Accounting questions

-

On January 1, 2013, Phoenix Co. acquired 100 percent of the outstanding voting shares of Sedona Inc. for $862,900 cash. At January 1, 2013, Sedonas net assets had a total carrying amount of $622,500....

-

On September 1, 2011, A Company purchased 100 percent of the voting stock of B Company for $480,000 in cash. The separate condensed balance sheets immediately after the purchase were as follows:...

-

On January 1, 2014, Company P purchased 100 percent of the outstanding voting shares of Company S in the open market for $ 80,000 cash. On that date, the separate statements of financial position...

-

The following is the ending balances of accounts at December 31, 2018, for the Weismuller Publishing Company. Additional Information: 1. Prepaid expenses include $120,000 paid on December 31, 2018,...

-

Rotech Co. began operations in January 2011. The information below is for Rotech Co.'s operations for the three months from January to March (the first quarter) of 2012: Expenses for Quarter 1...

-

Temple Limited has been offered two new contracts, the details of which are as follows: The fixed overhead has been apportioned on the basis of direct labour cost. Temple is a one-product firm. Its...

-

Wage distribution. A group of researchers analyzed the wage distribution in Malaysia and published their findings in the Journal of Physics in 2020. They used the data collected from the Salaries and...

-

Flex Displays designs and manufactures displays used in mobile devices. Serious flooding throughout North Carolina affected Flex Displays facilities. Inventory was completely ruined, and the companys...

-

Hilltop Company produces three products, D, R, and B. The following information is available for Hilltop Company's most recent month of operations: Hilltop Company : Sales revenue ....................

-

Skolnick Co. was organized on April 1, 2022. The company prepares quarterly financial statements. The following adjusted balance amounts at June 30 are in alphabetical order. a. Prepare an income...

-

Maxwell Industries paid $18 per share for 80 percent of the 10,000 outstanding shares of Kendall Hall. The balance sheet of Kendall Hall and additional market value information follow. a. Compute the...

-

O'Leary Enterprises began investing in short-term equity securities in 2011. The following information was extracted from its 2011 internal financial records. Houser and Miller were classified as...

-

Describe the difference between a defined benefit pension fund and a defined contribution pension fund.

-

The pulse rates of 152 randomly selected adult males vary from a low of 37 bpm to a high of 117 bpm. Find the minimum sample size required to estimate the mean pulse rate of adult males. Assume that...

-

A rod 12.0 cm long is uniformly charged and has a total charge of -23.0 C. Determine the magnitude and direction of the electric field along the axis of the rod at a point 32.0 cm from its center....

-

Hello need help with this problem. The transactions relating to the formation of Blue Company Stores Incorporated, and its first month of operations follow. a. The firm was organized and the...

-

At the beginning of the year, the net assets of Shannon Company were $492,600. The only transactions affecting stockholders equity during the year were net income of $70,200 and dividends of $15,400....

-

The claim is that smokers have a mean cotinine level greater than the level of 2.84 ng/mL found for nonsmokers. (Cotinine is used as a biomarker for exposure to nicotine.) The sample size is n = 739...

-

Kasch and his brother owned M.W. Kasch Co. Kasch hired Skebba as a sales representative and over the years promoted him first to account manager; then to customer service manager, field sales...

-

Classify each of the following activities as proper or prohibited under the various consumer statutes you have studied. a. Calling a hospital room to talk to a debtor who is a patient there. b....

-

On the Forbes 2018 list of the Worlds Billionaires, Jeff Bezos, founder and CEO of Amazon, ranks at the top with a net worth of $112 billion. Does this richest man in the world face scarcity, or does...

-

Garmen Oil Company recently discovered an oil field on one of its properties in Texas. In order to extract the oil, the company purchased drilling equipment on January 1, 2017, for $800,000 cash and...

-

Webb Net Manufacturing purchased a new net weaving machine on January 1, 2015, for $500,000. The new machine has an estimated life of five years and an estimated salvage value of $100,000. It is...

-

The following financial information was taken from the records of Frederickson and Peffer. a. Reconstruct the entry that recorded the sale of equipment during 2017. b. How much equipment was...

-

Mediocre Company has sales of $120,000, fixed expenses of $24,000, and a net income of $12,000. If sales rose 10%, the new net income would be: Question 18 options: $16,800 $36,000 $13,200 $15,600

-

1. Why might managers of small restaurants decide not to adopt the standard work hour approach to controlling labour cost? (minimum 150 words )

-

Which statement is true regarding the U.S. GAAP impairment test for limited life intangibles? A. U.S. GAAP impairment is likely to be greater than IFRS impairment. B. The impairment test for limited...

Study smarter with the SolutionInn App