Hot on the Spot Doughnuts has computed the net present value for capital expenditure locations A and

Question:

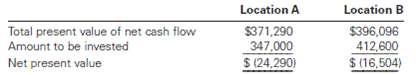

Hot on the Spot Doughnuts has computed the net present value for capital expenditure locations A and B, using the net present value method. Relevant data related to the computation are as follows:

Determine the present value index for eachproposal.

Location A Location B Total present value of net cash flow Amount to be invested Net present value $371,290 $396,096 412,600 $ (16,504) $ (24,290)

Step by Step Answer:

Present Value Index Total Present Value of net Cas...View the full answer

Accounting

ISBN: 978-0324662962

23rd Edition

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Cost Accounting questions

-

Dippin doughnuts has computed the net present value for capital expenditure at two locations. Relevant data related to the computation are as follows: (a) Determine the present value index each...

-

Tasty Doughnuts has computed the net present value for capital expenditure at two locations. Relevant data related to the computation are as follows: a. Determine the present value index for each...

-

Drive By Doughnuts has computed the net present value for capital expenditure locations A and B, using the net present value method. Relevant data related to the computation are as follows: Determine...

-

You measure 30 textbooks' weights, and find they have a mean weight of 72 ounces. Assume the population standard deviation is 4 ounces. Based on this, construct a 90% confidence interval for the true...

-

Consider a 2-curve with df = 16. Obtain the 2-value that has area a. 0.025 to its left. b. 0.975 to its left. Find the required 2-values. Illustrate your work graphically.

-

Suppose you observe the following situation: Assume these securities are correctly priced. Based on the CAPM, what is the expected return on the market? What is the risk-free rate? Security Beta...

-

Convince yourself that (11.9) is correct. (11.9)

-

A manufacturer claims that through the use of a fuel additive, automobiles should achieve, on average, an additional 5 miles per gallon of gas. A random sample of 100 automobiles was used to evaluate...

-

Computer Wizards Ltd. has determined that its Net Income for Tax Purposes, before any CCA deductions, was $ 80,000, for the taxation year ending December 31, 2020. As Computer Wizards Ltd. does not...

-

Calculate the number of ATPs generated from the metabolic oxidation of the four carbons of acetoacetyl-CoA to CO2. Now consider the homolog derived from oxidation of an odd-numbered carbon chain,...

-

Carnival Corporation has recently placed into service some of the largest cruise ships in the world. One of these ships, the Carnival Dream, can hold up to 3,600 passengers and cost $750 million to...

-

MVP Sports Equipment Company is considering an investment in one of two machines. The sewing machine will increase productivity from sewing 150 baseballs per hour to sewing 270 per hour. The...

-

1. What are the relevant costs and benefits relating to the Garden Bridge? 2. Why might managers be reluctant to abandon loss-making projects?

-

When a supersonic airflow, \(M=1.8\), passes through a normal shockwave under sea level conditions, what are the values of the stagnation pressure before and after the normal shockwave?

-

Eastern University, located in central Canada, prides itself on providing faculty and staff with a competitive compensation package. One aspect of this package is a tuition benefit of \($4,000\) per...

-

What is the formula for calculating return on investment (ROI)?

-

Air enters a 5.5-cm-diameter adiabatic duct with inlet conditions of \(\mathrm{Ma}_{1}=2.2, T_{1}=250 \mathrm{~K}\), and \(P_{1}=60 \mathrm{kPa}\), and exits at a Mach number of...

-

At the various activity levels shown, Taylor Company incurred the following costs. Required: Identify each of these costs as fixed, variable, or mixed. Units sold 20 40 60 80 100 a. Total salary cost...

-

Identify firms in your region that are multinational. In what parts of the world do they operate? How recently have they become multinational? If possible, invite a representative of one of the firms...

-

Quadrilateral EFGH is a kite. Find mG. E H <105 G 50 F

-

Provide an example of an object from your discipline and suggest the kinds of properties and methods that the object can have.

-

(Postretirement Benefit Worksheet) Using the information in *E20-19, prepare a worksheet inserting January 1, 2010, balances, and showing December 31, 2010, balances. Prepare the journal entry...

-

(Postretirement Benefit Expense Computation) Garner Inc. provides the following information related to its postretirement benefits for the year 2010. Accumulated postretirement benefit obligation at...

-

(Postretirement Benefit Expense Computation) Engle hart Co. provides the following information about its postretirement benefit plan for the year 2010. Compute the postretirement benefit expense...

-

Aecerty 1067687 was completed with the folowing charaderistick Murulectere sec00 5xs:99 s35ida sputed

-

Assume todays settlement price on a CME EUR futures contract is $1.3180 per euro. You have a long position in one contract. EUR125,000 is the contract size of one EUR contract. Your performance bond...

-

Q2. Company ABC bought an equipment for $20,000 in 2015, with useful life of 5 years $5,000 residual value amortized using straight-line method. Prepare a table to illustrate the differences...

Study smarter with the SolutionInn App