Tasty Doughnuts has computed the net present value for capital expenditure at two locations. Relevant data related

Question:

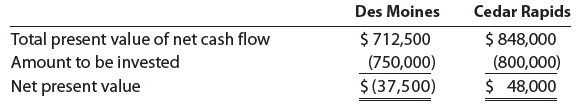

Tasty Doughnuts has computed the net present value for capital expenditure at two locations. Relevant data related to the computation are as follows:

a. Determine the present value index for each proposal.

b. Which location does your analysis support? Explain.

Cedar Rapids Des Moines Total present value of net cash flow Amount to be invested Net present value $ 712,500 (750,000) $ 848,000 (800,000) $ (37,500) $ 48,000

Step by Step Answer:

a b The analysis supports investing in Cedar Rapids becau...View the full answer

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Business questions

-

Drive By Doughnuts has computed the net present value for capital expenditure locations A and B, using the net present value method. Relevant data related to the computation are as follows: Determine...

-

Double K Doughnuts has computed the net present value for capital expenditure at two locations. Relevant data related to the computation are as follows: a. Determine the present value index for each...

-

Dip N' Dunk Doughnuts has computed the net present value for capital expenditure at two locations. Relevant data related to the computation are as follows: a. Determine the present value index for...

-

Mark Cotteleer owns a company that manufactures sailboats, Actual demand for Marks sailboats during each season in 2006 through 2009 was as follows: Mark has forecasted that annual demand for his...

-

In each of the following cases calculate the indicated derivatives, justifying all operations. (a) (b) (c) (d) dz

-

Evaluate the integral using the methods covered in the text so far. Sz COS X 2 sin x + 3 dx

-

4. Assuming that the LIBOR rate is 5.5 percent on December 31, 2017, prepare all the necessary entries to account for the interest rate swap at December 31, 2017, including the 2017 interest payment....

-

In a recent balance sheet, Microsoft Corporation reported Property, Plant, and Equipment of $15,082 million and Accumulated Depreciation of $7,547 million. a. What was the book value of the fixed...

-

View transaction list of 7 Journal entry worksheet 3:00:05 Record the consumption of supplies during the month if supplies worth $4,000 were purchased on January 5 and at the end of the month...

-

Fundamentals of Income Tax 2019 Owen (SIN 805 232 105) and Sonja (SIN 805 232 212) Cornell are married. They live at 2621 River Road, Your City, YP, P0M 1B0, phone number 983-2425. Owen was born on...

-

Carnival (CCL) has recently placed into service some of the largest cruise ships in the world. One of these ships, the Carnival Breeze, can hold up to 3,600 passengers, which can cost $750 million to...

-

The internal rate of return method is used by Testerman Construction Co. in analyzing a capital expenditure proposal that involves an investment of $113,550 and annual net cash flows of $30,000 for...

-

XYZ stock price and dividend history are as follows: Year _________ Beginning-of-Year Price _________ Dividend Paid at Year-End 2010 ........................ $100...

-

Anna feels paralyzed by depression and anxiety. When she is able to sleep, her dreams are full of nightmares. If we learn that Anna is a refugee from the civil war in Syria: a. we can better...

-

PART 1 (35 MARKS) A pressure vessel is a specialized container designed to hold gases or liquids at significantly high pressures from the ambient pressure. These vessels play a critical role in...

-

EV9-1 Normal TIME TIME A 1x A TIME A Activity Normal Normal Maximum Crash Time Cost Crash Time Cost 100 A B C D E F B 3 C 4 B C B 1 3 4 3 4 3 150 200 200 200 150 D3 E 4 E D E 0 2 1 1 2 1 LL 3 F F 0...

-

Question 1: You overheard your investment advisor saying, "Don't put all the eggs into the same basket. Explain the meaning of this statement. Explain three (3) reasons of why your investment advisor...

-

* * Audit Procedures for Auditor's Responsibility for Risk Assessment * * In auditing, risk assessment is a critical phase where auditors identify and evaluate risks that may impact the financial...

-

Return on a company's net operating assets is commonly used to evaluate financial performance. One way to increase performance is to focus on operating assets. REQUIRED: Indicate how this might be...

-

Imagine you are the HR manager at a company, and a female employee came to you upset because she felt a male coworker was creating a hostile work environment by repeatedly asking her out on dates...

-

Distinguish between the following pairs of items that appear on operating statements: (a) Gross sales and net sales, (b) Purchases at billed cost and purchases at net cost.

-

How does gross margin differ from gross profit? From net profit?

-

Explain the similarity between markups and gross margin. What connection do markdowns have with the operating statement?

-

Aecerty 1067687 was completed with the folowing charaderistick Murulectere sec00 5xs:99 s35ida sputed

-

Assume todays settlement price on a CME EUR futures contract is $1.3180 per euro. You have a long position in one contract. EUR125,000 is the contract size of one EUR contract. Your performance bond...

-

Q2. Company ABC bought an equipment for $20,000 in 2015, with useful life of 5 years $5,000 residual value amortized using straight-line method. Prepare a table to illustrate the differences...

Study smarter with the SolutionInn App