The internal rate of return method is used by Testerman Construction Co. in analyzing a capital expenditure

Question:

The internal rate of return method is used by Testerman Construction Co. in analyzing a capital expenditure proposal that involves an investment of $113,550 and annual net cash flows of $30,000 for each of the six years of its useful life.

a. Determine a present value factor for an annuity of $1, which can be used in determining the internal rate of return.

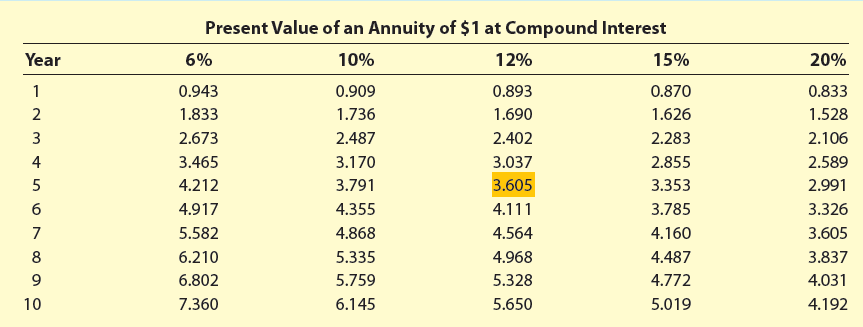

b. Using the factor determined in part (a) and the present value of an annuity table appearing in Exhibit 5 of this chapter, determine the internal rate of return for the proposal.

Exhibit 5:

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Forensic And Investigative Accounting

ISBN: 9780808056300

10th Edition

Authors: G. Stevenson Smith D. Larry Crumbley, Edmund D. Fenton

Question Posted: