Howdy Company keeps its accounting records on a cash basis during the year. At year-end, it adjusts

Question:

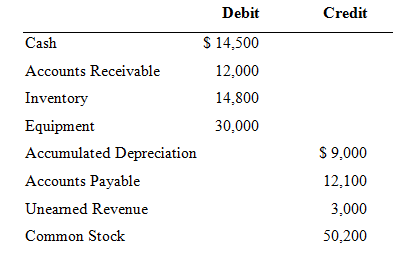

Howdy Company keeps its accounting records on a cash basis during the year. At year-end, it adjusts its books to the accrual basis for preparing its financial statements. At the end of 2011, Howdy Company reported the following balance sheet items:

It is now the end of 2012. The company’s checkbook shows cash receipts from customers of $87,000 and cash payments of $77,400. An examination of the cash payments revealed the following:

$43,200 was paid to suppliers for inventory

$30,000 was paid for operating costs

$4,200 was paid on January 1, 2012 for a two-year insurance policy

On December 31, 2012, the following other information was available:

Customers owed Howdy $18,500

Howdy owed suppliers $16,500

Howdy owed their employees $900

Howdy owed their customers $6,000 in services.

Howdy’s ending inventory balance was $15,400.

Additionally, Howdy is depreciating their equipment using straight-line depreciation over a 10-year life (no salvage value).

Required:

Using accrual-based accounting, answer the following. Note that you are not required to consider the tax impact of these transactions.

a. Revenues for 2012:

b. Cost of Goods Sold for 2012:

c. Operating costs for 2012:

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0324300987

10th Edition

Authors: Loren A Nikolai, D. Bazley and Jefferson P. Jones