Huang Industries is considering a proposed project whose estimated NPV is $12 million. This estimate assumes that

Question:

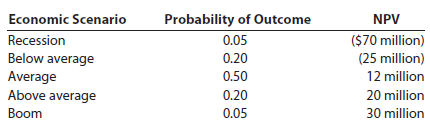

Huang Industries is considering a proposed project whose estimated NPV is $12 million. This estimate assumes that economic conditions will be “average.” However, the CFO realizes that conditions could be better or worse, so she performed a scenario analysis and obtained these results:

Calculate the project’s expected NPV, standard deviation, and coefficient of variation.

Economic Scenario Recession Below average Average Above average Probability of Outcome NPV ($70 million) (25 million) 12 million 0.05 0.20 0.50 0.20 20 million 30 million 0.05 Boom

Step by Step Answer:

ENPV 00570 02025 05012 02020 00530 ...View the full answer

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Corporate Finance questions

-

Shao Industries is considering a proposed project for its capital budget. The company estimates the project's NPV is $12 million. This estimate assumes that the economy and market conditions will be...

-

Shao Industries is considering a proposed project for its capital budget. The company estimates that the project's NPV is $12 million. This estimate assumes that the economy and market conditions...

-

The board of Kopi Industries is considering a new dividend policy that would set dividends at 60% of earnings. The recent past has witnessed earnings per share (EPS) and dividends paid per share as...

-

1. If France can make 25 pounds of butter or 5 lamps while Spain can make 6 pounds of butter or 1 lamp, who has the comparative advantage in which good? A. France has the comparative advantage in...

-

Rita is a self-employed taxpayer who turns 39 years old at the end of the year (2016). During 2016, her net Schedule C income was $300,000.This was her only source of income. This year, Rita is...

-

Explain the following. a. Hydroelectric power is a relatively cheap source of electricity. b. Geothermal energy is a non-polluting form of energy. c. A disadvantage of wind power is that it causes...

-

What is a merchants firm offer?

-

Presented below is financial information related to the 2017 operations of Sea Legs Cruise Company. Maintenance and repairs expense ....... $ 95,000 Utilities expense ............... 13,000 Salaries...

-

Dawson, Emerson, and Franklin have operated a bookstore for a number of years as a partnership. At the beginning of 2019, capital balances were as follows: Dawson $80,000 Emerson $50,000 Franklin...

-

1. Discuss the main issues faced by Yalla Momos. 2. Evaluate the current financial performance of Yalla Momos and compare his performance to the industry ratios. 3. Elaborate on the relevant factors...

-

Kristin is evaluating a capital budgeting project that should last 4 years. The project requires $800,000 of equipment. She is unsure what depreciation method to use in her analysis, straight-line or...

-

You must evaluate a proposed spectrometer for the R&D Department. The base price is $140,000, and it would cost another $30,000 to modify the equipment for special use by the firm. The equipment...

-

Ted is traveling in his railroad car at speed v relative to Alice. He is also carrying a light clock in his luggage. Alice compares notes with Ted and finds that each tick of the light clock takes...

-

Explain the memory layout of a C program and discuss how different segments of memory are managed. ?

-

Explain the "volatile" keyword in C. Where and why would you use it?

-

What is the difference between malloc() and Calloc() ?

-

GATE-2024(Electrical Engineering) question. Q.10 A surveyor has to measure the horizontal distance from her position to a distant reference point C. Using her position as the center, a 200 m...

-

What advantages do limited liability partnerships offer to businesspersons that are not offered by general partnerships? AppendixLO1

-

B.) What is the approximate concentration of free Zn 2+ ion at equilibrium when 1.0010 -2 mol zinc nitrate is added to 1.00 L of a solution that is 1.080 M in OH - . For [Zn(OH) 4 ] 2- , K f = 4.610...

-

Demonstrate that the following series are convergent and determine their value. a. (-0.99)k+10 b. 12(+)5 vo(1)" (0.2)"-7 d. _100 10 (0.95)2 C. 5j

-

Is the equation used to value preferred stock more like the one used to value a bond or the one used to value a normal constant growth common stock? Explain. Explain the following statement:...

-

Why might the calculated intrinsic value differ from the stocks current market price? Which would be correct, and what does correct mean?

-

What steps are taken to find a stock price using the corporate valuation model?

-

Present Value Computations Using the present value tables, solve the following. ( Click here to access the PV and FV tables to use with this problem. ) Round your answers to two decimal places....

-

A company provided the following data: Sales $887,000 Variable costs $546,800 Fixed costs $310,000 Expected production and sales in units 36,000 What is the break-even point in sales dollars? Please...

-

How to solve them..equation and explain ..please.. 1. Selected information from the companys financial records is presented below Equipment, December 31, 2013 $300,000 Equipment, December 31, 2014...

Study smarter with the SolutionInn App