Question: 1. Discuss the main issues faced by Yalla Momos. 2. Evaluate the current financial performance of Yalla Momos and compare his performance to the industry

1. Discuss the main issues faced by Yalla Momos.

2. Evaluate the current financial performance of Yalla Momos and compare his performance to the industry ratios.

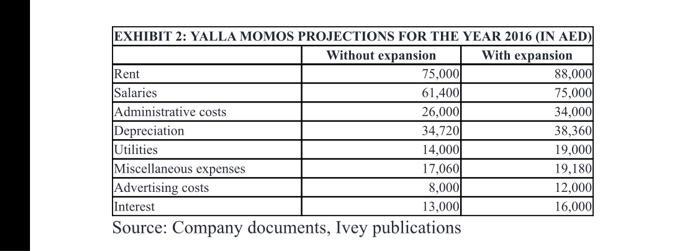

3. Elaborate on the relevant factors that need to be considered when deciding to expand.

4. How can companies like Yalla Momos benefit from CVP analysis? Calculate the 2015 BEP and Margin of safety (MOS) in quantity and monetary terms.

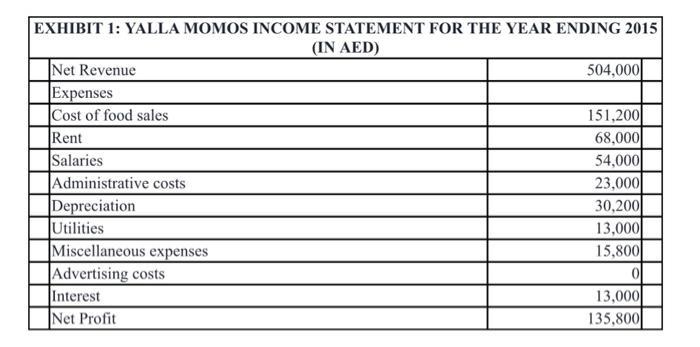

EXHIBIT 1: YALLA MOMOS INCOME STATEMENT FOR THE YEAR ENDING 2015 (IN AED) Net Revenue Expenses Cost of food sales Rent Salaries Administrative costs Depreciation Utilities Miscellaneous expenses 504,000 151,200 68,000 54,000 23,000 30,200 13,000 15,800 Advertising costs Interest Net Profit 13,000 135,800

Step by Step Solution

3.57 Rating (157 Votes )

There are 3 Steps involved in it

1 Answer The company is concerned with sales growth in 2016 As the Dubai market prepared for themuchawaited Expo 2020 competition was getting tough and it had become hard tomaintain low prices because ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

60915c5d9c938_207273.pdf

180 KBs PDF File

60915c5d9c938_207273.docx

120 KBs Word File