Igor, the intern at FinCorp Inc., has just presented your boss, Mr. Cabinet, with his valuation of

Question:

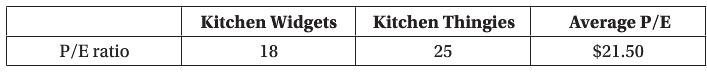

Igor, the intern at FinCorp Inc., has just presented your boss, Mr. Cabinet, with his valuation of Kitchen Gadget Company (KGC). Igor has identified two other companies, Kitchen Widgets and Kitchen Thingies, in exactly the same line of business as KGC and carried out his valuation using multiples. All three companies use 100-percent equity. Igor presents the following analysis:

As KGC has an EPS of $1, Igor has valued it at $21.50 per share. Mr. Cabinet looks at Igor’s work, tells him to do it again, and mumbles something about “notes to the statements.” Igor is utterly confused and has come to you for help. You have quickly reviewed Igor’s work and noticed that KGC has a policy of buying all its assets; in contrast, Kitchen Widgets uses operating leases while Kitchen Thingies uses financial or capital leases.

a. Explain to Igor what the “notes to the statements” are.

b. Explain how he should have done the valuation.

c. Is this likely to affect his valuation of KGC?

Step by Step Answer:

Introduction To Corporate Finance

ISBN: 9781118300763

3rd Edition

Authors: Laurence Booth, Sean Cleary