In this simulation, you are asked to address questions related to the accounting for leases. Prepare responses

Question:

In this simulation, you are asked to address questions related to the accounting for leases. Prepare responses to allparts.

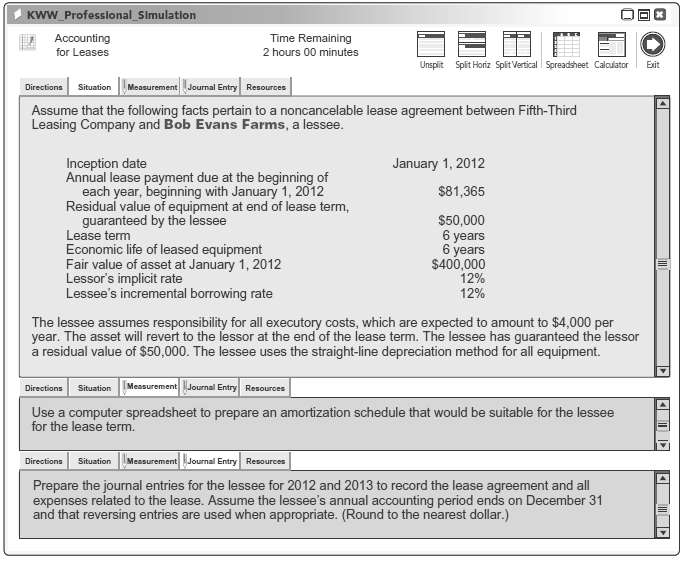

KWW Professlonal Simulation Accounting Time Remaining for Leases 2 hours 00 minutes Unsplit Split Horiz Spit Vertical Spreadsheet Calculator Exit Measurement Journmal Entry Resources Directions Situation Assume that the following facts pertain to a noncancelable lease agreement between Fifth-Third Leasing Company and Bob Evans Farms, a lessee. January 1, 2012 Inception date Annual lease payment due at the beginning of each year, beginning with January 1, 2012 Residual value of equipment at end of lease term, guaranteed by the lessee Lease term Economic life of leased equipment Fair value of asset at January 1, 2012 Lessor's implicit rate Lessee's incremental borrowing rate $81,365 $50,000 6 years 6 years $400,000 12% 12% The lessee assumes responsibility for all executory costs, which are expected to amount to $4,000 per year. The asset will revert to the lessor at the end of the lease term. The lessee has guaranteed the lessor a residual value of $50,000. The lessee uses the straight-line depreciation method for all equipment. Messurement Journal Entry Resources Directions Situation Use a computer spreadsheet to prepare an amortization schedule that would be suitable for the lessee for the lease term. Measurement Journal Entry Resources Directions Situation Prepare the journal entries for the lessee for 2012 and 2013 to record the lease agreement and all expenses related to the lease. Assume the lessee's annual accounting period ends on December 31 and that reversing entries are used when appropriate. (Round to the nearest dollar.)

Step by Step Answer:

Resources This lease is a capital lease to the lessee because the lease term six years exceeds 75 of the economic life of the asset six years Also the ...View the full answer

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Accounting questions

-

In this simulation, you are asked to address questions related to investments. Prepare responses to allparts. KWW_Professional Simulation Time Remaining 3 hours 20 minutes Investments Unspit Split...

-

In this simulation, you are asked to address questions regarding the accounting for property, plant, and equipment. Prepare responses to allparts. KWW Professional_Simulation 1 Property, Plant, and...

-

In this simulation, you are asked to address various requirements regarding the accounting for receivables. Prepare responses to allparts. KWW Professlonal Simulation E Accounting for Receivables...

-

An operations manager wants to examine the effect of air-jet pressure (in pounds per square inch [psi]) on the breaking strength of yam. Three different levels of air-jet pressure are to be...

-

What are the typical management fees, and front and back load fees?

-

If L(p) is the Lorenz curve associated with the random variable X, show that |X d. L(p) E[X]

-

Barkley Companys adjusted trial balance on March 31, 2013, its fiscal year-end, follows On March 31, 2012, merchandise inventory was $37,500. Supplementary records of merchandising activities for the...

-

1. Should you discuss the matter first with Troy before responding to Joyce? Explain. 2. Assume Kristen is a Certified Management Accountant and member of the Institute of Management Accountants. As...

-

Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. Current Year 1 Year Ago 2 Years Ago At December 31 Assets...

-

Create a scenario and a dialogue for a Coaching process using the GROW model then write a Reflective essay on Coaching process using the GROW model. The piece should discuss for example, what you...

-

Daniel Hardware Co. is considering alternative financing arrangements for equipment used in its warehouses. Besides purchasing the equipment outright, Daniel is also considering a lease. Accounting...

-

In this simulation, you are asked to address questions related to the accounting for leases. Prepare responses to all parts. (Round amounts to the nearestcent.) KWW Professional Simulation Time...

-

Hoosier Industries is a U. S. multinational corporation with two wholly owned subsidiaries: one in Malaysia and one in Japan. Assume the local tax rates are 35% in the United States, 20% in Malaysia,...

-

Dr. Kovaleski is interested in examining whether quantity of sleep impacts problem solving ability. To test problem solving ability, the research team gave participants a puzzle and measured how long...

-

Can you please help me fill out the spreadsheet? Idexo Corporation is a privately held designer and manufacturer of licensed college apparel in Cincinnati, Ohio. In late 2020, after several years of...

-

CHECK FIGURE: Adjusted book balance = $2,837.06 Mae Telford, the controller of the Baylor Company, provided the following information: Bank statement balance Add: Baylor Company Bank Reconciliation...

-

Read the Scenario Congratulations, you are now the Police Chief in Anytown, USA. A city with 30,000 residents and you are responsible to provide 24 hour a day police coverage. You have a total of 45...

-

Here are summary statistics for randomly selected weights of newborn girls: n = 36, x = 3180.6 g, s = 700.5 g. Use a confidence level of 99% to complete parts (a) through (d) below. a. Identify the...

-

Remedies. Genix, Inc., has contracted to sell Larson fi ve hundred washing machines of a certain model at list price. Genix is to ship the goods on or before December 1. Genix produces one thousand...

-

The column shown in the figure is fixed at the base and free at the upper end. A compressive load P acts at the top of the column with an eccentricity e from the axis of the column. Beginning with...

-

Suppose the underlying asset is paying a continuous dividend yield at the rate q, the two governing equations for u,d and p are modified as Show that the parameter values in the binomial model are...

-

The Stern Company uses a perpetual inventory system and has prepared the following adjusted trial balance on December 31, 2007: Required Prepare in proper form for 2007 the company's: (1) Income...

-

The Nealy Company has prepared the following alphabetical adjusted trial balance on December 31, 2007: Required Prepare the following 2007 items in proper form for the Nealy Company: (1) The income...

-

The following 2007 information is available concerning the Drake Company, which adjusts and closes its accounts every December 31: 1. Salaries accrued but unpaid total $2,840 on December 31, 2007. 2....

-

On April 1, year 1, Mary borrowed $200,000 to refinance the original mortgage on her principal residence. Mary paid 3 points to reduce her interest rate from 6 percent to 5 percent. The loan is for a...

-

Give a numerical example of: A) Current liabilities. B) Long-term liabilities?

-

Question Wonder Works Pte Ltd ( ' WW ' ) produces ceramic hair curlers to sell to department stores. The production equipment costs WW $ 7 0 , 0 0 0 four years ago. Currently, the net book value...

Study smarter with the SolutionInn App