Installment-Sales Computations and Entries Paul Dobson Stores sell appliances for cash and also on the installment plan.

Question:

Installment-Sales Computations and Entries Paul Dobson Stores sell appliances for cash and also on the installment plan. Entries to record cost of sales are made monthly.

The accounting department has prepared the following analysis of cash receipts for the year.

Cash sales (including repossessed merchandise)..........$424,000

Installment accounts receivable, 2010.................................96,000

Installment accounts receivable, 2011...............................109,000

Other........................................................................................36,000

Total.....................................................................................$665,000

Repossessions recorded during the year are summarized as follows.

? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? 2010

Uncollected balance..............................................................$8,000

Loss on repossession.................................................................800

Repossessed merchandise.....................................................4,800

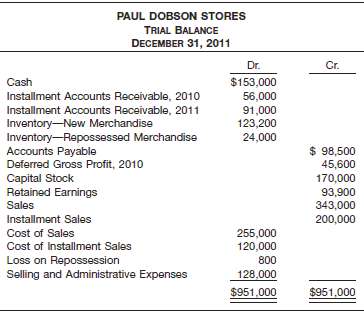

From the trial balance and accompanying information:

(a) Compute the rate of gross profit on installment sales for 2010 and 2011.

(b) Prepare closing entries as of December 31, 2011, under the installment-sales method of accounting.

(c) Prepare an income statement for the year ended December 31, 2011. Include only the realized gross profit in the incomestatement.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield