Jefferson Mountain is a small ski resort located in central Pennsylvania. In recent years, the resort has

Question:

Jefferson Mountain is a small ski resort located in central Pennsylvania. In recent years, the resort has experienced two major problems: (1) unusually low annual snowfalls and (2) long lift lines. To remedy these problems, management is considering two investment proposals. The first involves a $125,000 investment in equipment used to make artificial snow. The second involves the $180,000 purchase of a new high-speed chairlift.

The most that the resort can afford to invest at this time is $200,000. Thus, it cannot afford to fund both proposals. Choosing one proposal over the other is somewhat problematic. If the resort funds the snow-making equipment, business will increase, and lift lines will become even longer than they are currently. If it funds the chairlift, lines will be shortened, but there may not be enough natural snow to attract skiers to the mountain.

The following estimates pertain to each of these investment proposals:

-1.png)

Neither investment is expected to have any salvage value. Furthermore, the only difference between incremental cash flow and incremental income is attributable to depreciation. Due to inherent risks associated with the ski industry and the resort’s high cost of capital, a minimum return on investment of 20 percent is required.

Instructions

a. Compute the payback period of each proposal.

b. Compute the return on average investment of each proposal.

c. Compute the net present value of each proposal using the tables in Exhibits 26–3 and 26–4.

d. What nonfinancial factors should be considered?

e. Which proposal, if either, do you recommend as a capital investment?

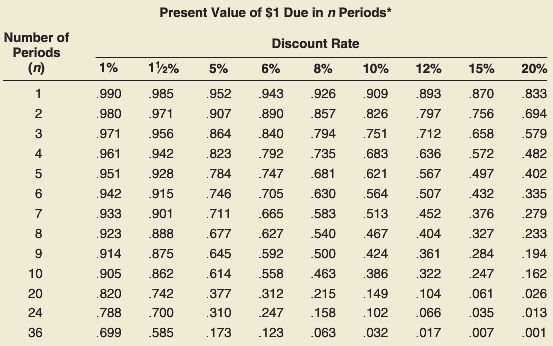

In Exhibits 26–3

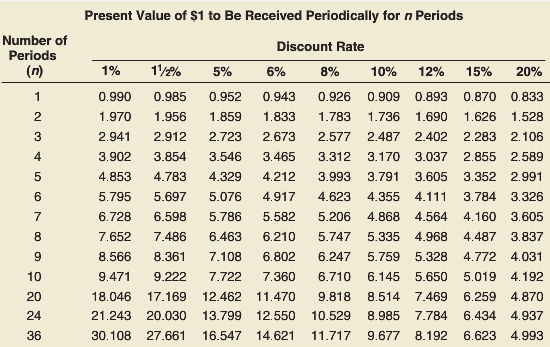

In Exhibits 26–4

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Financial and Managerial Accounting the basis for business decisions

ISBN: 978-0078111044

16th edition

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello