Kim Corporation, a calendar year taxpayer, has manufacturing facilities in States A and B. A summary of

Question:

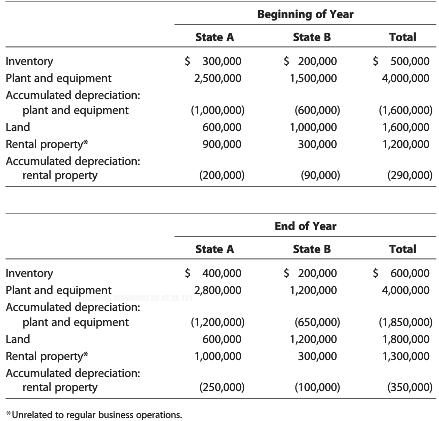

Kim Corporation, a calendar year taxpayer, has manufacturing facilities in States A and B. A summary of Kim’s property holdings follows.

Determine Kim’s property factors for the two states assuming that the statutes of both A and B provide that average historical cost of business property is to be included in the property factor.

Transcribed Image Text:

Beginning of Year Inventory Plant and equipment Accumulated depreciation: State A $300,000 2,500,000 State B $ 200,000 1,500,000 Total S500,000 4,000,000 plant and equipment Land Rental property* Accumulated depreciation: (1,000,000) 600,000 900,000 (600,000) 1,000,000 300,000 (1,600,000) 1,600,000 1,200,000 rental property (200,000) (90,000) (290,000) End of Year Total 600,000 4,000,000 State A State B S 400,000 2,800,000 S 200,000 Inventory Plant and equipment Accumulated depreciation: 1,200,000 plant and equipment Land Rental property* Accumulated depreciation: (1,200,000) 600,000 1,000,000 (650,000) 1,200,000 300,000 (1,850,000) 1,800,000 1,300,000 rental property (250,000) (100,000) (350,000) *Unrelated to regular business operations.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (14 reviews)

Under the statutes of States A and B accumulated depreciation and nonbusiness pr...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Corporations questions

-

Beige Corporation (a calendar year taxpayer) has taxable income of $150,000, and its financial records reflect the following for the year. Federal income taxes paid $75,000 Net operating loss...

-

Red Corporation, a calendar year taxpayer, has taxable income of $600,000. Among its transactions for the year are the following: Collection of proceeds from insurance policy on life of corporate...

-

Beebe Corporation (a calendar year taxpayer) has taxable income of $150,000, and its financial records reflect the following for the year. Federal income taxes paid $75,000 Net operating loss carry...

-

Two thousand kg of water, initially a saturated liquid at 150C, is heated in a closed, rigid tank to a final state where the pressure is 2.5 MPa. Determine the final temperature, in C. the volume of...

-

In questions a through d, indicate whether you would use the table for determining the future value of a single sum ( FVIF ), the present value of a single sum ( PVIF ), the future value of an...

-

Will you bother to draw an organization chart for your restaurant? Justify your decision. AppendixLO1

-

4. A parent company and its subsidiaries are separate legal entities. Hence, they have separate accounting records. Explain why they might need to be consolidated.

-

Best Appliances is a retail store that sells household appliances. Merchandise sales are subject to an 8 percent sales tax. The firm's credit sales for July are listed below, along with the general...

-

In August of 2019, the Parliamentary Joint Committee on Corporations and Financial Services commenced an inquiry into auditing regulation in Australia. This inquiry was instigated by the ASIC...

-

On September 1, 201X, Brittney Slater opened Brittney?s Art Studio. The following transactions occurred in September: Your tasks are to do the following: 1. Set up the ledger based on the following...

-

Josie is a sales representative for Talk2Me, a communications retailer based in Fort Smith, Arkansas. Josie's sales territory is Oklahoma, and she regularly takes day trips to Tulsa to meet with...

-

True Corporation, a wholly owned subsidiary of Trumaine Corporation, generated a $400,000 taxable loss in its first year of operations. True's activities and sales are restricted to State A, which...

-

Suppose that the licensure requirements for health care providers were eliminated. Use supply-and-demand analysis to predict what may happen to the price and quantity of health care services. Are...

-

Which one of the following therapists' approaches has been integrated into several other therapies in the West? 1. Naikan therapy 2. Morita therapy 3. mindfulness meditation

-

What does this scatter plot tell us? Check ALL below that are true from the Scatter Plot. Y is cumulative total barrels and x is number of active wells. 1. If there were 550 active wells, we would...

-

Millie runs a small company that makes customised notebooks with personalised details on the cover and inserts. You promote your product as a great gift idea, and your holiday orders break your...

-

Excel ACC 311 Project Two Workbook Template - View-only Search (Alt + Q) File Home Insert Draw Page Layout Formulas Data Review View Help 12 B A ... ab Ev F10 1 2 3 4 5 6 fx A B Posey's Pet Emporium...

-

Imagine that you are the change manager for acompany that does business entirely via the Internet. The head development engineercalls to indicate he wants to make a small change to one of the...

-

The numbers 5, 17, 18, 27, 36, and 41 were drawn in the last lottery; they should not be bet on in the next lottery because they are now less likely to occur. For Exercises 58, decide whether the...

-

Find the center of mass of a thin triangular plate bounded by the y-axis and the lines y = x and y = 2 - x if (x, y) = 6x + 3y + 3.

-

The manufacturing records for Kool Kayaks at the end of the 2008 fiscal year show the following information about manufacturing overhead: Requirements 1. How many machine hours did Kool Kayaks use in...

-

Pablo has a $63,000 basis in his partnership interest. On May 9 of the current tax year, the partnership distributes to him, in a proportionate nonliquidating distribution, cash of $25,000, cash...

-

Pablo has a $63,000 basis in his partnership interest. On May 9 of the current tax year, the partnership distributes to him, in a proportionate nonliquidating distribution, cash of $25,000, cash...

-

When Brunos basis in his LLC interest is $150,000, he receives cash of $55,000, a proportionate share of inventory, and land in a distribution that liquidates both the LLC and his entire LLC...

-

How do external factors such as changing consumer preferences affect the retail industry?"

-

Production costs that are not attached to units that are sold are reported as: Cost of goods sold Selling expenses Administrative costs Inventory

-

Please show workings :) Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected information on the four projects follows: Life of...

Study smarter with the SolutionInn App